Despite a persistent reliance on fossil fuels across many sectors, global markets are emerging as the primary catalyst for the energy transition, transforming climate ambitions into tangible, investable realities. While industrial energy consumption, particularly coal, and the transportation sector’s near-ubiquitous dependence on oil products underscore the ongoing dominance of traditional energy sources, a significant shift is underway. For the first time in the first half of 2025, renewable energy sources have surpassed coal as the leading contributor to the global energy supply. This pivotal moment is not a serendipitous occurrence but a direct consequence of market dynamics, with environmental commodity markets providing the essential scaffolding and support structure for this profound transformation.

The concept of environmental commodities can be illustrated through a relatable analogy. Consider an individual residing in an apartment who wishes to reduce their carbon footprint. While installing solar panels on their own roof might be impractical, they could partner with a friend who owns a house, assisting with the financing of solar installations on the friend’s property. In return, the apartment dweller can then claim to have offset their carbon emissions. This scenario mirrors the macro-level actions of energy producers, corporations, and major industries. It establishes a marketplace for decarbonisation opportunities, enabling entities constrained in their ability to implement green initiatives to invest in decarbonisation efforts elsewhere. Simultaneously, it empowers those with the capacity to develop sustainable projects but lacking the necessary capital to secure funding and bring their ventures to fruition.

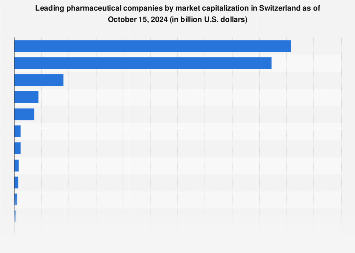

These market-based mechanisms are the fundamental levers driving the energy transition. Emissions Trading Systems (ETS), which assign a monetary value to carbon emissions, were first introduced in 2005. Concurrently, the significance of renewable energy certificates (such as Guarantees of Origin, International Renewable Energy Certificates, and Renewable Energy Certificates) has grown substantially. These instruments link clean energy generation with consumer demand. Furthermore, fuel mandates, like the Low Carbon Fuel Standard (LCFS) and the EU’s Renewable Energy Directive III (RED III), incentivize the adoption of low-carbon alternatives. The core purpose of these markets is not merely symbolic but to accurately account for the economic cost of emissions and render decarbonisation a financially viable undertaking. Much like in other sophisticated markets, intermediaries such as STX Group play a crucial role in structuring pricing mechanisms and delivering climate solutions that streamline transactions and mitigate risks for both buyers and producers. This market-driven approach injects vital investment into the transition, cementing its position as an indispensable component of the broader commodities landscape.

The energy transition is ultimately propelled by three critical pathways: enhancing energy efficiency, transitioning to renewable fuels and feedstocks, and implementing carbon capture technologies. However, the scalability of these efforts hinges entirely on their investability, which is intrinsically linked to the appropriate pricing of carbon emissions. The current economic climate offers encouraging signs, as carbon is increasingly being valued accurately, leading to a robust expansion of environmental commodity markets over the past two decades. Regulatory frameworks are also evolving rapidly, particularly across Europe, impacting a diverse range of industries. In the maritime sector, initiatives like FuelEU Maritime are actively reshaping fuel demand patterns. The aviation industry is witnessing a surge in the adoption of sustainable fuels driven by ReFuelEU mandates. RED III is compelling EU member states to elevate the share of renewables in their power and heating sectors. The Carbon Border Adjustment Mechanism (CBAM) is creating a more equitable playing field for domestic and international producers within the EU. Collectively, these regulatory measures exert greater pressure on European refineries to increase their output of clean energy products. This regulatory push, coupled with the expanding presence of renewable energy, directly translates into heightened demand for environmental certificates, thereby rendering the transition an attractive investment prospect. The future trajectory of the burgeoning "sustainable economy" is predominantly shaped by the expanding scope of regulatory compliance, which has also become a critical lifeline for energy companies navigating markets that are swiftly pivoting towards renewable energy sources.

While the pace of global decarbonisation efforts may still be considered incremental by some, the impact of market-driven schemes like ETS and the diverse array of environmental commodities in capping and addressing emissions cannot be overlooked. To contextualize the scale of this market, the global market for Environmental Attribute Certificates (EACs) has experienced remarkable growth since its formalization in the early 2000s, now exceeding 2,400 terawatt-hours (TWh) annually. This volume is equivalent to more than 60 percent of the European Union’s total electricity demand. Presently, these markets encompass approximately 40 percent of the EU’s total greenhouse gas emissions and generated an estimated €38 billion in revenue in 2024.

An updated assessment reveals that over 70 countries have now implemented carbon pricing systems. Mandates and schemes promoting clean fuels are gaining traction across North America and Asia. In Europe, a multitude of clean energy policies and regulations are effectively embedding carbon as a balance-sheet cost for major heavy industries, including aviation, shipping, and manufacturing. The landscape is poised for further significant developments, with numerous schemes anticipated to exert a substantial impact in the coming years. These include sustainable aviation fuel certificates (SAFc), white certificates designed to promote energy efficiency, and biofuel mandates. One undeniable reality is that emissions now carry a discernible price, and this price is on an upward trajectory.

The conviction is strong that market mechanisms represent the most efficient pathway to harmonizing political aspirations, corporate responsibilities, and consumer demand for decarbonisation at an economically feasible cost. Without these market forces, the energy transition risks becoming a protracted, more expensive, and ultimately more divisive endeavor.