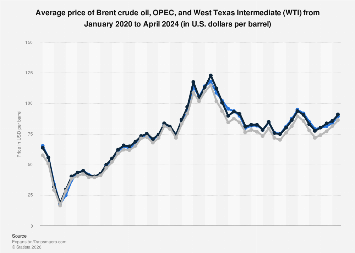

The international oil market is experiencing a complex interplay of supply-side dynamics, geopolitical tensions, and economic recovery forecasts, leading to fluctuating price points for key benchmarks like Brent crude, OPEC’s basket, and West Texas Intermediate (WTI). While early 2024 saw a relative calm, with prices for these benchmarks remaining below the critical $90 per barrel threshold and even trailing levels observed just before the escalation of the Russia-Ukraine conflict in February 2022, recent developments are reshaping market sentiment and projecting a potential upward price trajectory for the remainder of the year.

The initial months of 2024 offered a period of price moderation. For instance, in January, Brent crude averaged around $80.12 per barrel, WTI at $74.15, and OPEC’s basket at $80.04. February saw a slight increase, with Brent reaching $83.48, WTI $77.25, and OPEC $81.22. March continued this trend, with Brent at $85.41, WTI at $81.28, and OPEC at $84.13. This stability, however, proved to be a temporary phase, as the underlying geopolitical fragilities began to assert their influence. By April, the average prices had climbed further, with Brent hitting $90.84, WTI $86.21, and OPEC $89.57, signaling a clear shift in market dynamics.

The significant catalyst for this shift appears to be the heightened tensions in the Middle East. The ongoing conflict between Iran and Israel, coupled with the protracted war in Gaza, has introduced a substantial risk premium into the oil markets. These geopolitical flashpoints directly threaten the stability of supply routes and production centers in a region that is central to global energy flows. Any disruption, whether actual or perceived, to oil production or transportation from the Middle East can have immediate and far-reaching consequences for global prices.

Examining historical data reveals the sensitivity of oil prices to such geopolitical events. The period between March and April 2020 serves as a stark reminder of market volatility, albeit driven by different factors. During that time, the unprecedented demand shock caused by the COVID-19 pandemic, coupled with a price war between Saudi Arabia and Russia, sent prices plummeting. In April 2020, WTI even briefly traded at negative prices, a historic anomaly, with the average for the month at a mere $16.55 per barrel. Brent was at $18.38, and OPEC’s basket at $17.64. This demonstrated the extreme swings possible when both supply and demand fundamentals are severely disrupted.

In contrast, the recovery seen in the subsequent years highlights the market’s resilience and its tendency to rebalance. By January 2021, prices had begun to recover, with Brent averaging $54.77 and WTI $52. The market continued its upward trajectory through 2021, with Brent reaching highs of $83.54 in October. However, the invasion of Ukraine in February 2022 triggered another significant price surge. Brent crude briefly surpassed $100 per barrel, with the February 2022 average at $97.13, WTI at $91.64, and OPEC at $94.21. Prices then spiked even higher in March 2022, with Brent reaching an average of $117.25, WTI $108.50, and OPEC $113.61, reflecting immediate supply concerns and sanctions imposed on Russia, a major energy producer.

The price moderation seen in late 2022 and early 2023, with Brent averaging around $80-$82 and WTI in the $70s for several months, indicated a period of relative market equilibrium, influenced by a combination of OPEC+ production cuts aimed at stabilizing prices and concerns about a potential global economic slowdown dampening demand. However, the data from January to April 2024 clearly shows a renewed upward pressure. The rise from $80.12 for Brent in January to $90.84 in April is a significant 13.4% increase within a single quarter. Similarly, WTI saw a 16.3% rise from $74.15 to $86.21, and OPEC’s basket increased by 11.9% from $80.04 to $89.57.

The economic implications of these price movements are substantial and multifaceted. For oil-exporting nations, higher prices translate into increased revenues, potentially boosting government budgets and foreign exchange reserves. This can fuel domestic spending, infrastructure projects, and investment. Conversely, for oil-importing nations, rising crude prices lead to higher energy costs for consumers and businesses, contributing to inflation and potentially widening trade deficits. This can put pressure on central banks to raise interest rates, which could, in turn, slow economic growth.

Globally, elevated oil prices can impact various sectors. Transportation, a major consumer of petroleum products, faces increased operational costs for airlines, shipping companies, and logistics providers. This can lead to higher prices for goods and services. The petrochemical industry, a key downstream user of crude oil, also faces increased input costs, potentially affecting the prices of plastics, fertilizers, and other essential materials. Energy-intensive industries, such as manufacturing and heavy industry, may see their profitability squeezed, potentially leading to reduced output or investment.

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, a group known as OPEC+, play a pivotal role in managing global oil supply. Their production decisions are closely watched by markets as they can significantly influence price levels. The group has implemented voluntary production cuts to support prices, and their commitment to these cuts, alongside their response to potential supply disruptions, will be critical in shaping the market’s trajectory.

Looking ahead, several factors will continue to influence oil prices. The ongoing geopolitical situation in the Middle East remains a primary concern. The extent of any supply disruptions and the duration of regional conflicts will be key determinants of price volatility. Furthermore, global economic growth prospects will influence demand. A robust economic recovery, particularly in major consuming nations like China and India, could boost demand and support higher prices. Conversely, a significant economic slowdown could dampen demand and exert downward pressure on crude.

The transition to cleaner energy sources also presents a long-term factor, but in the short to medium term, oil remains the dominant energy source for many sectors. The pace of this transition, coupled with investment in renewable energy and electric vehicles, will gradually influence oil demand patterns. However, for the foreseeable future, the dynamics of supply, driven by both conventional production and geopolitical stability, alongside demand influenced by global economic activity, will remain the primary drivers of benchmark oil prices. The current price levels, while not yet at the extreme peaks seen in 2022, indicate a market that is increasingly factoring in the risks of supply instability, suggesting that the era of sub-$80 oil may be temporarily on hold.