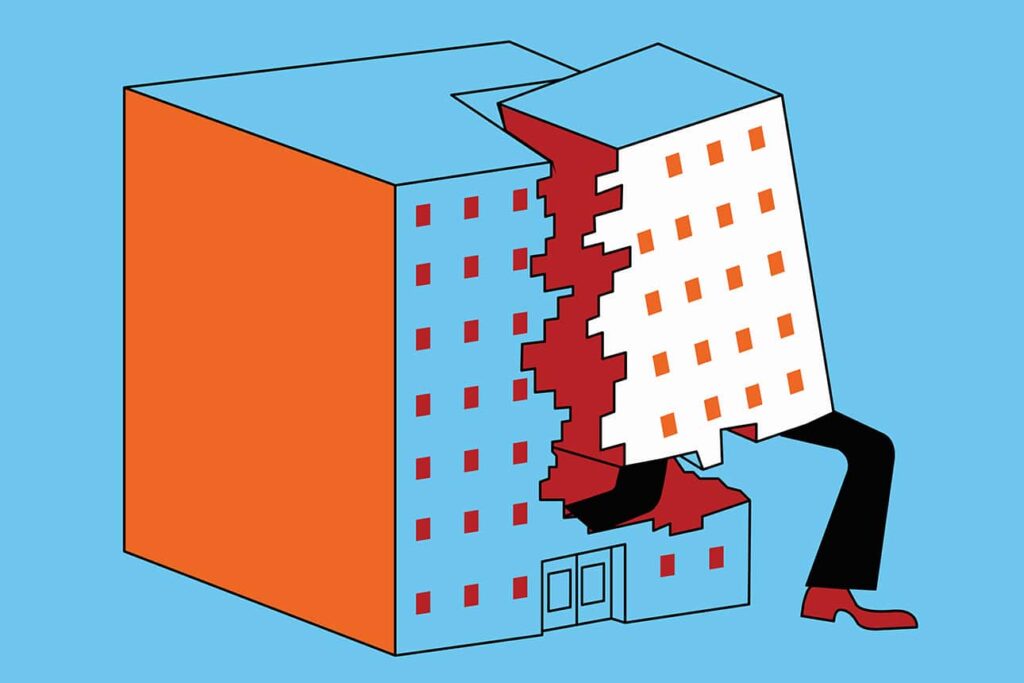

Organizations across sectors are grappling with unprecedented levels of uncertainty, demanding a paradigm shift in how future risks and opportunities are assessed. For central banks, the custodians of national economic stability, this imperative is magnified. Their ability to anticipate and navigate complex, often non-linear, future scenarios is paramount to safeguarding monetary and financial systems and maintaining public trust. The Bank of England, affectionately known as "The Old Lady of Threadneedle Street," has actively embarked on an initiative to significantly broaden its strategic outlook, moving beyond traditional quantitative risk frameworks to embrace more qualitative, long-term horizon-scanning capabilities.

Historically, central banks emerged from periods of profound economic disruption. The Bank of Amsterdam in 1608 addressed coinage debasement, Sweden’s Riksbank in 1668 restored confidence after a financial crisis, and the Bank of England itself was founded in 1694 to finance a war. These origins underscore their fundamental role as reactive stabilizers. Today, while their core mandates remain centred on monetary policy, financial stability, and prudential regulation, the nature of threats has evolved dramatically. The structured, quantitative risk management frameworks that underpin central banking – focused on credit, market, operational, and policy risks, alongside robust reserves and liquidity buffers – are indispensable but increasingly insufficient for the challenges of the 21st century.

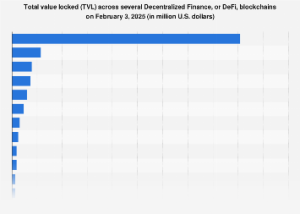

The contemporary landscape is characterized by a confluence of novel and interconnected risks that defy conventional modelling. Algorithmic trading, for instance, has introduced flash crashes, heightened market volatility, and complex interdependencies that can rapidly amplify shocks across financial markets, sometimes within milliseconds. Geopolitical instability, ranging from trade wars and energy shocks to cyber warfare and regional conflicts, disrupts global supply chains, fuels inflationary pressures, and introduces significant uncertainty into investment decisions. Beyond these, the existential threat of climate change presents both physical risks (extreme weather events impacting infrastructure and productivity) and transition risks (economic shifts associated with decarbonization, potentially stranding assets and disrupting industries). The rapid advancement of artificial intelligence, distributed ledger technologies like cryptocurrencies, and even demographic shifts and future pandemics, all represent profound challenges that require a more imaginative and forward-looking approach.

Traditional risk management, while robust for quantifiable probabilities and known unknowns, often struggles with "black swan" events or "unknown unknowns" – scenarios that fall outside historical precedents or are driven by complex systemic interactions. For a central bank, relying solely on models that extrapolate from past data can create blind spots to emerging, transformative risks. This realization spurred leaders at the Bank of England to cultivate longer-term horizon-scanning capabilities, aiming to enrich their understanding of potential future states and their implications for the UK economy and financial system.

The core challenge lay in integrating these new foresight methodologies into a deeply entrenched, highly quantitative risk management culture. Central banking, by its very nature, is data-driven, evidence-based, and reliant on rigorous statistical analysis. Introducing concepts like "creative storytelling" – a term used to describe the development of plausible future scenarios and narratives – required a significant cultural shift. It necessitated persuading skilled economists, statisticians, and financial analysts of the strategic value in qualitative exploration and imaginative scenario building, not as a replacement for quantitative analysis, but as a vital complement.

The Bank’s approach involved fostering an environment where diverse perspectives could converge to envision potential futures. This meant moving beyond siloed departmental thinking and encouraging interdisciplinary collaboration. Experts from monetary policy, financial stability, supervision, and technology functions were brought together to explore a wider spectrum of possibilities. The "creative storytelling" aspect facilitated this by enabling participants to construct coherent narratives around hypothetical future developments, exploring their causal pathways and potential impacts. This process helped to identify weak signals, challenge underlying assumptions, and articulate complex interdependencies that might otherwise remain hidden within purely numerical models. For example, a narrative exploring a future where sovereign digital currencies are widespread might reveal novel vulnerabilities in cross-border payments or challenges to monetary policy transmission, which might not surface in a standard risk register.

Lessons learned during this transformative journey highlighted the critical importance of leadership buy-in and a willingness to embrace iterative processes. It wasn’t about imposing a new methodology but about demonstrating its utility through practical application and tangible insights. Workshops and collaborative sessions were instrumental in demystifying the process and showcasing how scenario planning could stress-test existing strategies, uncover vulnerabilities, and identify nascent opportunities. The aim was to build a collective intelligence about the future, enabling more resilient policy frameworks and proactive responses, rather than merely reactive ones.

This proactive stance at the Bank of England is not an isolated phenomenon; it reflects a broader trend among central banks and international financial institutions. The European Central Bank (ECB) has been at the forefront of developing climate-related stress tests for financial institutions, pushing banks to quantify the financial risks from climate change. The US Federal Reserve has increasingly focused on the systemic risks posed by technological innovation and cyber threats. The Bank for International Settlements (BIS) consistently publishes research on the future of finance, exploring topics like central bank digital currencies (CBDCs) and the implications of big tech in finance. Even sovereign wealth funds, such as Norges Bank Investment Management, employ long-term scenario planning to navigate geopolitical and environmental shifts impacting their vast portfolios. These parallel initiatives underscore a global consensus: an expanded, more holistic view of risk is essential for navigating the complexities of the 21st-century economy.

The economic impact of cultivating such strategic foresight is profound. By proactively identifying and analyzing potential future risks, central banks can develop more robust macroprudential policies, ensuring the financial system is better equipped to absorb shocks. Monetary policy can become more adaptable, factoring in long-term structural changes rather than solely reacting to short-term fluctuations. Furthermore, enhanced foresight capabilities can guide regulatory efforts, encouraging innovation while mitigating systemic risks in emerging areas like decentralized finance. This proactive approach not only bolsters financial stability but also contributes to long-term economic growth by reducing uncertainty for businesses and investors, fostering confidence, and enabling more efficient capital allocation. The Bank of England’s commitment to broadening its future perspectives represents a crucial evolution in central banking, ensuring that "The Old Lady" remains a vigilant and adaptive guardian of economic prosperity in an increasingly unpredictable world.