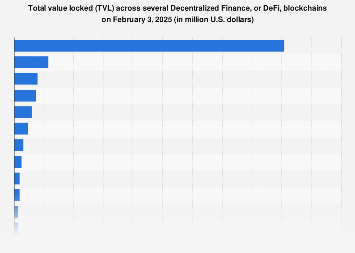

The burgeoning landscape of decentralized finance (DeFi) is on an upward trajectory, with projections indicating substantial growth in its Total Value Locked (TVL) across various blockchain networks through 2025. This key metric, representing the total amount of capital deposited in DeFi protocols, serves as a critical barometer for the health and expansion of this innovative financial ecosystem. As decentralized applications (dApps) continue to mature and attract a wider user base, the underlying blockchain infrastructure supporting them is set to witness a commensurate increase in locked assets.

The evolution of DeFi is intrinsically linked to the scalability and efficiency of the underlying blockchain technologies. While early DeFi applications primarily resided on Ethereum, the network’s historical challenges with transaction speed and high gas fees spurred the development and adoption of alternative Layer 1 blockchains and Layer 2 scaling solutions. This diversification has been instrumental in accommodating the growing demand and preventing network congestion, thereby fostering a more robust and accessible DeFi environment.

Ethereum, despite the emergence of competitors, continues to hold a significant, albeit fluctuating, share of the DeFi market. Its extensive developer community, established network effects, and ongoing upgrades like the transition to Proof-of-Stake (PoS) have solidified its position. However, other blockchains have carved out substantial niches by offering distinct advantages. Solana, for instance, has attracted significant capital due to its high throughput and low transaction costs, enabling faster and more cost-effective execution of complex DeFi operations. Binance Smart Chain (BSC), now BNB Chain, has also been a major player, leveraging its compatibility with the Ethereum Virtual Machine (EVM) and its strong ties to the Binance exchange to draw in retail and institutional investors seeking lower fees and quicker transaction confirmations.

The narrative of DeFi TVL is not solely about the total sum but also about the dynamic shifts in dominance between these blockchain ecosystems. As of recent data, Ethereum consistently commands the largest portion of the total DeFi TVL. However, the percentage share held by competing networks has seen notable increases, reflecting a maturing market where users and developers are actively seeking the most efficient and cost-effective platforms for their decentralized financial activities. This competition is a healthy sign for the overall DeFi space, as it incentivizes innovation and drives down costs for end-users.

Looking ahead to 2025, analysts predict a continued expansion of the total DeFi TVL. Several factors are expected to fuel this growth. Firstly, increasing institutional adoption of digital assets and blockchain technology is a significant tailwind. As more traditional financial institutions explore and integrate DeFi protocols, they are likely to bring substantial capital into the ecosystem, thereby boosting TVL. Secondly, the ongoing development of user-friendly interfaces and intuitive dApps will lower the barrier to entry for retail investors, broadening the appeal of decentralized finance beyond the crypto-native community.

Furthermore, the maturation of DeFi products themselves will play a crucial role. Innovations in areas such as decentralized derivatives, insurance, lending, and stablecoins are continuously expanding the utility and potential returns available within the DeFi space. As these products become more sophisticated and reliable, they will attract more capital seeking yield and diversification opportunities. The development of cross-chain interoperability solutions is also paramount. As protocols become more adept at communicating and transferring assets between different blockchains, users will be able to access a wider array of DeFi services without being confined to a single network, further increasing the overall locked value.

The economic impact of this projected growth is multifaceted. For the underlying blockchain networks, increased TVL translates into higher demand for their native tokens, which are often used for transaction fees, governance, and staking. This can lead to increased network security and decentralization as more participants are incentivized to hold and utilize the tokens. For developers, a growing TVL signifies a larger addressable market and greater potential for revenue generation through protocol fees and token appreciation.

On a broader economic level, the expansion of DeFi could lead to greater financial inclusion by providing access to financial services for individuals who are unbanked or underbanked. It also offers new avenues for investment and capital formation, potentially stimulating economic activity. However, this growth is not without its risks. Regulatory uncertainty remains a significant factor, as governments worldwide grapple with how to oversee this rapidly evolving sector. Cybersecurity threats, smart contract vulnerabilities, and the inherent volatility of digital assets also pose challenges that could impact TVL and broader market confidence.

In terms of global comparisons, the DeFi landscape is predominantly driven by innovation and capital flows originating from North America and Europe, though Asia has also emerged as a significant hub for development and adoption. The regulatory approaches taken by different jurisdictions will likely influence where capital flows and where innovation thrives. Regions with more progressive and clear regulatory frameworks may attract more DeFi activity and, consequently, a larger share of the global TVL.

The projected growth of DeFi TVL through 2025 underscores a fundamental shift in how financial services are conceived and delivered. While the exact figures will depend on a complex interplay of technological advancements, market sentiment, and regulatory developments, the underlying trend points towards a sustained and significant expansion of decentralized finance. The competition among blockchain networks to host this expanding ecosystem will continue to drive innovation, pushing the boundaries of what is possible in the realm of open, permissionless, and global finance. The coming years will be critical in shaping the long-term trajectory of DeFi and its integration into the broader global economy.