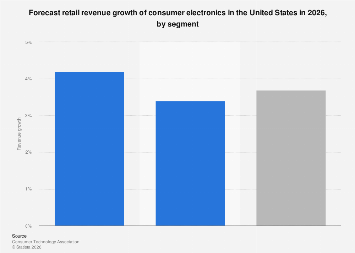

The United States consumer electronics market is projected to experience a modest increase in retail revenue in 2026, with an estimated growth rate of *** percent compared to the preceding year. This expansion is expected to be notably fueled by the software and services segment, which is anticipated to outpace the growth observed in hardware sales. This trend underscores a broader shift in consumer spending patterns within the technology landscape, emphasizing recurring revenue streams and value-added digital offerings over solely physical product purchases.

The consumer electronics industry itself is an expansive and multifaceted sector, encompassing a vast array of products that cater to both entertainment and utility needs. From high-definition televisions and cutting-edge gaming consoles to sophisticated personal computers and a wide range of mobile devices, the industry is central to modern daily life. Beyond core digital devices, the sector also includes audio equipment, smart home appliances, and even components of musical instruments like electric guitars and digital keyboards. Globally, the United States and China stand as the two largest markets for consumer electronics, representing significant hubs for both consumption and innovation.

Examining the granular breakdown of retail revenue growth within the U.S. consumer electronics market for 2026 reveals distinct trajectories for various sub-segments. While specific figures for individual categories like televisions, PCs, smartphones, tablets, wearables, cameras, and XR (extended reality) devices are typically part of proprietary market intelligence, the overarching forecast points to a differentiated performance across these areas. The dominance of software and services in driving overall growth suggests that companies focusing on subscription models, cloud-based solutions, digital content, and post-purchase support are likely to see more robust revenue increases. This could translate to higher growth rates for sectors that enable these services, such as advanced networking equipment or components that facilitate seamless digital integration.

The increasing penetration of smart home technology, for instance, relies heavily on the continuous development and delivery of software updates, app-based control, and often, subscription services for enhanced features or security. Similarly, the gaming industry, a significant component of consumer electronics, has seen a dramatic shift towards digital downloads, online multiplayer services, and in-game purchases, all of which fall under the software and services umbrella. Even traditional hardware sales are increasingly influenced by the software ecosystems they support; a new smartphone’s appeal is often tied to its operating system, available apps, and cloud integration capabilities.

This strategic pivot towards software and services is not unique to the U.S. market; it is a global phenomenon driven by several converging factors. Firstly, the increasing sophistication of hardware has led to longer product lifecycles for many devices, meaning consumers are not upgrading their physical devices as frequently as they once did. This necessitates a shift in revenue generation strategies for manufacturers and retailers. Secondly, the recurring revenue models offered by software and services provide greater predictability and stability for businesses, a key consideration in today’s dynamic economic climate. Thirdly, the growing demand for personalized experiences and integrated solutions means consumers are increasingly willing to pay for services that enhance the functionality and utility of their devices.

The economic implications of this trend are substantial. For businesses, a stronger focus on software and services can lead to improved profit margins, as the cost of developing and distributing digital products is often lower than that of manufacturing physical goods. It also fosters stronger customer relationships through ongoing engagement and support. For consumers, while it might involve a higher upfront cost for some hardware, the long-term value derived from enhanced functionality, continuous updates, and personalized services can represent a more compelling proposition.

However, this transition also presents challenges. The competitive landscape for software and services is intense, requiring significant investment in research and development, marketing, and customer service. Companies must also navigate evolving data privacy regulations and cybersecurity threats. Furthermore, ensuring equitable access to these digital services across different socioeconomic groups remains a critical consideration for policymakers and industry leaders alike.

Looking ahead, the continued evolution of technologies such as artificial intelligence, 5G connectivity, and virtual and augmented reality will likely further accelerate the growth of the software and services segment within the consumer electronics market. These emerging technologies are inherently reliant on robust digital infrastructure and sophisticated software platforms to deliver their full potential. As such, businesses that can effectively integrate hardware innovation with compelling software and service offerings are best positioned to thrive in the evolving U.S. consumer electronics landscape of 2026 and beyond. The projected growth, while moderate overall, signals a strategic maturation of the industry, moving towards a more service-oriented and value-driven ecosystem.