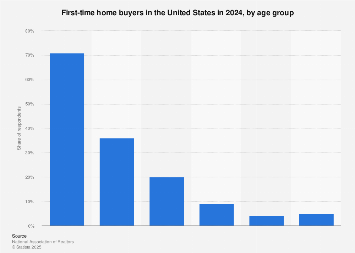

The demographic profile of individuals entering the U.S. housing market for the first time is undergoing a significant transformation, with younger generations, particularly Millennials and Gen Z, increasingly dominating this segment. While specific percentages for 2024 remain subject to updated data releases, historical trends and current economic indicators point towards a substantial proportion of home purchases within the 26 to 34 age bracket being driven by first-time buyers. Concurrently, the 35 to 44 age group, while still a notable contributor to first-time purchases, sees a greater prevalence of individuals who have already established a homeownership history. This divergence highlights the evolving timelines and financial realities shaping entry into the property market.

The pronounced presence of Gen Z (ages 18-24) and Millennials (ages 25-43) among first-time homebuyers is a predictable outcome of their generational lifecycle. These cohorts are typically navigating the foundational stages of their professional lives. Many are either in the nascent phases of their careers or, in some instances, still engaged in higher education. This developmental stage often coincides with significant financial burdens, most notably the persistent challenge of student loan debt. The accumulation of these educational liabilities can significantly impede their ability to save for a substantial down payment, a crucial prerequisite for purchasing a home in the United States. Consequently, the journey to homeownership for these younger demographics often necessitates a prolonged period of rigorous saving, stretching years beyond what might have been typical for previous generations.

The economic pressures faced by these younger generations are not isolated incidents but are reflected in broader market trends. For instance, data from the Federal Reserve indicates a steady increase in student loan debt, which has surpassed $1.7 trillion in recent years. This financial overhang directly impacts disposable income and savings capacity, making the hurdle of accumulating a down payment – often estimated to be tens of thousands of dollars – a formidable obstacle. Furthermore, the rising cost of housing across many metropolitan areas in the U.S. exacerbates this challenge. According to the National Association of Realtors, median home prices have seen consistent year-over-year growth, pushing starter homes further out of reach for those with limited capital.

Understanding the timeline of homeownership also sheds light on these generational dynamics. First-time buyers, particularly those from younger cohorts, tend to retain their initial properties for a considerable duration. This longer holding period for starter homes means that the pool of individuals actively selling their primary residences is often comprised of older demographics, who have had more time to build equity and potentially upgrade to larger, more expensive properties. The concept of a "trade-up" home, a larger and more affluent dwelling, typically becomes accessible after a homeowner has resided in their first property for several years. This progression is generally facilitated by career advancement and subsequent income growth, allowing individuals to leverage their existing home equity and increased financial capacity.

The economic rationale behind this progression is straightforward: the share of income required to finance a trade-up home is often considerably lower than the initial outlay needed for a starter home. This is due to a combination of factors, including accumulated equity from the sale of the first property, potentially higher incomes, and a more established credit history. As individuals move up the career ladder, their earning potential increases, making it more feasible to take on larger mortgages and invest in properties that better suit their evolving lifestyle and financial standing.

Globally, the challenges faced by first-time homebuyers in the U.S. are not unique. Many developed nations are experiencing similar trends of rising housing costs, student debt burdens, and an increasing age at which individuals achieve homeownership. In countries like Canada, Australia, and the United Kingdom, similar demographic shifts are observed, with younger generations grappling with affordability issues. For instance, the average age of a first-time buyer in the UK has been steadily increasing, with many individuals delaying purchases well into their thirties and forties due to similar economic constraints.

The economic implications of these shifting demographics are far-reaching. A delayed entry into homeownership can impact wealth accumulation for younger generations, as real estate has historically been a significant asset for building long-term wealth. It can also influence consumer spending patterns, as mortgage payments and property-related expenses can divert funds from other discretionary purchases. Furthermore, the housing market’s health is intricately linked to broader economic stability. A robust market, characterized by consistent new buyer activity, contributes to construction, employment, and ancillary industries. Conversely, prolonged affordability challenges can lead to market stagnation and potential economic headwinds.

The current interest rate environment also plays a critical role in the affordability equation. While interest rates have seen fluctuations, their elevated levels in recent years have increased the monthly cost of mortgages, further stretching the budgets of prospective homeowners. This, coupled with persistent inflation across various goods and services, creates a complex economic landscape for those aspiring to enter the housing market. The ability of policymakers and financial institutions to address these multifaceted challenges will be crucial in shaping the future of first-time homeownership in the United States and ensuring a more equitable path to property acquisition for younger generations. The ongoing dialogue surrounding housing policy, student loan relief, and wage growth will undoubtedly influence the demographic trends observed in the U.S. housing market for years to come.