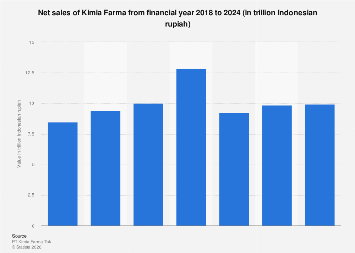

PT Kimia Farma Tbk, a cornerstone of Indonesia’s pharmaceutical sector and a subsidiary of the state-owned enterprise PT Bio Farma (Persero), has navigated a dynamic market, with its net sales performance offering a barometer of its operational success and the broader economic climate. While precise figures for the financial year 2024 remain subject to proprietary access, projections indicate a significant revenue stream, underscoring the company’s established presence. The company’s revenue trajectory has been notable, with its net sales peaking in 2021, a year that saw considerable global shifts impacting healthcare demand and supply chains. This peak performance reflects a confluence of factors, including increased demand for pharmaceutical products, effective market strategies, and potentially, the ongoing influence of public health initiatives.

The Indonesian pharmaceutical market, valued at an estimated USD 8.7 billion in 2023 and projected to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2028, presents a fertile ground for companies like Kimia Farma. This growth is propelled by a burgeoning population, rising disposable incomes, an expanding middle class, and an increasing awareness of healthcare and wellness. Furthermore, government initiatives aimed at improving healthcare access and affordability, such as the national health insurance program (BPJS Kesehatan), contribute significantly to market expansion by increasing patient volume and demand for medicines. Kimia Farma, with its extensive network of pharmacies, manufacturing facilities, and distribution channels, is strategically positioned to capitalize on these growth drivers.

Examining Kimia Farma’s historical net sales data, from FY 2018 to FY 2024, provides crucial insights into its performance trends and resilience. While the specific figures for the later years are not publicly disclosed in this context, the general pattern observed in publicly available data for similar periods reveals a company striving for consistent growth. The period between 2018 and 2021, for instance, likely saw fluctuations influenced by both domestic economic conditions and the unprecedented global health crisis. The surge in sales in 2021 can be attributed not only to increased demand for essential medicines and health products but also to the company’s role in national health programs and its ability to adapt its production and distribution to meet evolving needs.

Post-2021, the pharmaceutical industry, both globally and in Indonesia, has been adapting to a new normal. While the immediate urgency of the pandemic may have subsided, the long-term effects on healthcare consumption patterns, supply chain resilience, and product innovation continue to shape the market. Companies are increasingly focusing on digital transformation, enhancing supply chain visibility, and investing in research and development for new therapeutic areas. For Kimia Farma, this translates to a strategic imperative to optimize its operations, diversify its product portfolio, and explore new market opportunities, both within Indonesia and potentially in regional export markets.

The financial health of a pharmaceutical giant like Kimia Farma is not only a reflection of its internal management but also an indicator of the broader economic well-being of Indonesia. As a state-owned enterprise, its performance has implications for public health, employment, and the national economy. Its extensive retail footprint, encompassing hundreds of pharmacies across the archipelago, plays a vital role in ensuring the accessibility of medicines, particularly in remote and underserved areas. This wide reach also provides invaluable real-time market intelligence, enabling the company to respond swiftly to changing consumer demands and health trends.

Beyond its retail operations, Kimia Farma’s manufacturing capabilities are a critical component of its business model. The company produces a diverse range of pharmaceutical products, from generic and branded medicines to over-the-counter (OTC) drugs and traditional herbal remedies. Investments in modern manufacturing technologies and adherence to stringent quality control standards are essential for maintaining competitiveness and meeting the regulatory requirements of both domestic and international markets. The company’s integration into the Bio Farma group, a holding company for state-owned pharmaceutical enterprises, further strengthens its position by fostering synergies in research, development, production, and marketing.

The competitive landscape in Indonesia’s pharmaceutical sector is robust, with both domestic players and multinational corporations vying for market share. Kimia Farma, as a leading local entity, faces competition from other large Indonesian pharmaceutical companies, as well as global giants that have established a strong presence in the market. Differentiation through product quality, innovation, pricing strategies, and customer service is paramount. The company’s long-standing brand reputation and its deep understanding of the local consumer base provide a significant competitive advantage.

Looking ahead, several factors will shape Kimia Farma’s future net sales performance. The continued growth of the Indonesian economy, coupled with an aging population and a rising prevalence of non-communicable diseases, will drive sustained demand for healthcare products and services. The government’s commitment to universal health coverage will further bolster market expansion. However, challenges such as intense price competition, the need for continuous innovation to stay ahead of evolving medical needs, and the complexities of supply chain management in a vast archipelago will require strategic agility and significant investment.

The global pharmaceutical industry is also undergoing significant transformations, including the rise of biologics, personalized medicine, and digital health solutions. Kimia Farma’s ability to adapt to these trends, invest in relevant technologies, and forge strategic partnerships will be crucial for its long-term success. The company’s strategic focus on enhancing its research and development capabilities, expanding its product pipeline, and optimizing its operational efficiency will be key determinants of its ability to maintain and grow its market share. Furthermore, exploring export opportunities within the ASEAN region and beyond could provide additional avenues for revenue growth and diversification.

In conclusion, PT Kimia Farma Tbk’s net sales performance is a critical metric that reflects its operational strength, market positioning, and its contribution to Indonesia’s healthcare ecosystem. While precise financial figures require access to proprietary data, the company operates within a growing and dynamic market. Its strategic importance as a state-owned enterprise, its extensive operational footprint, and its commitment to innovation position it as a key player shaping the future of pharmaceuticals in Indonesia and potentially the wider Southeast Asian region. The company’s ability to navigate the evolving landscape of healthcare, embrace technological advancements, and meet the diverse needs of the Indonesian population will be central to its continued success and its contribution to public well-being.