The resolution of a long-standing investigation into dividend tax maneuvers has reached a definitive milestone as HSBC agreed to a €300 million settlement with French authorities, bringing an end to a probe that has loomed over the bank’s European operations for years. This settlement, finalized with the Parquet National Financier (PNF), France’s elite financial crimes prosecutor, addresses allegations surrounding "Cum-Cum" trading strategies—a practice designed to help foreign investors evade taxes on dividends. The agreement represents one of the largest tax-related penalties in recent French history and underscores a broader, more aggressive stance taken by European regulators against sophisticated financial engineering that drains national coffers.

At the heart of the dispute is a practice known as dividend stripping, or "Cum-Cum" trades. These transactions involve a coordinated dance of share transfers where foreign investors, who are typically subject to a heavy withholding tax on dividends from French companies, temporarily transfer their holdings to a domestic bank or a tax-exempt entity just before the dividend payment date. Because the domestic entity is either exempt from the tax or can claim a credit, the tax is avoided. Once the dividend is paid out, the shares are returned to the original foreign owner, and the tax "savings" are split between the investor and the facilitating bank. While financial institutions have long argued that such practices constituted legitimate tax optimization, French prosecutors have increasingly categorized them as fraudulent schemes intended to deprive the state of rightful revenue.

The settlement utilizes the Convention Judiciaire d’Intérêt Public (CJIP), a legal mechanism in France similar to a deferred prosecution agreement in the United States or the United Kingdom. By opting for the CJIP, HSBC avoids a protracted public trial and a potential criminal conviction, which could have carried even more severe regulatory consequences and restricted its ability to operate in certain markets. For the French government, the €300 million payout serves as both a significant recovery of lost tax revenue and a powerful deterrent to other financial institutions still under the microscope.

This enforcement action did not occur in a vacuum. In March 2023, French authorities conducted a massive, coordinated raid on the offices of five major banks in Paris, including Société Générale, BNP Paribas, Exane (a subsidiary of BNP), Natixis, and HSBC. The operation involved more than 160 investigators and dozens of prosecutors, marking it as one of the largest financial investigations in the country’s history. The raids were part of a broader European effort to recoup billions of euros lost to dividend arbitrage schemes over the past two decades. Estimates from investigative journalist collectives and academic researchers suggest that "Cum-Cum" and its even more aggressive cousin, "Cum-Ex," have cost European taxpayers more than €150 billion since the early 2000s.

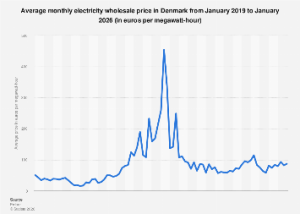

The distinction between "Cum-Cum" and "Cum-Ex" is critical for understanding the gravity of these probes. While "Cum-Cum" focuses on tax avoidance through temporary ownership transfers, "Cum-Ex" involved a more fraudulent methodology where multiple investors claimed tax refunds on a single dividend payment that was only taxed once—or sometimes not at all. While the "Cum-Ex" scandal centered largely on Germany and Denmark, the "Cum-Cum" practice was more widespread across the Eurozone, particularly in France, where the withholding tax on dividends for non-residents can reach up to 30%.

From an economic perspective, the crackdown on dividend arbitrage reflects a shifting paradigm in global tax enforcement. Following the 2008 financial crisis and the subsequent era of austerity, governments have faced mounting public pressure to ensure that large corporations and financial institutions pay their fair share. The emergence of the OECD’s Base Erosion and Profit Shifting (BEPS) framework has provided national regulators with the tools and the political mandate to pursue complex cross-border tax schemes that were previously overlooked or deemed too difficult to prosecute. In France, the PNF has been particularly emboldened, seeking to demonstrate that the French financial center is no longer a permissive environment for aggressive tax planning.

For HSBC, the settlement is a significant step toward clearing its "legacy" legal hurdles as it undergoes a massive strategic pivot. Under its current leadership, the London-headquartered bank has been aggressively divesting from non-core Western markets—including the sale of its French retail banking business to My Money Group—to focus its capital and resources on high-growth markets in Asia. Resolving the French tax probe removes a cloud of uncertainty that has hung over its remaining European corporate and institutional banking operations. However, the €300 million price tag is a stark reminder of the costs associated with historical practices that no longer align with modern regulatory expectations.

The impact of this settlement extends far beyond HSBC’s balance sheet. It sets a pricing benchmark for other banks currently embroiled in similar investigations. With several other major French and international banks still facing potential charges related to the 2023 raids, the HSBC deal provides a roadmap for how these institutions might negotiate their exits from the PNF’s crosshairs. Market analysts suggest that the total recoveries from the French banking sector could eventually exceed €1 billion as other cases reach resolution.

Furthermore, the settlement highlights the increasing importance of Environmental, Social, and Governance (ESG) criteria in the financial sector. Tax transparency and responsible tax behavior are increasingly viewed as core components of a bank’s "S" and "G" scores. Investors and institutional shareholders are no longer viewing tax settlements as merely a "cost of doing business" but as a failure of risk management and corporate ethics. Banks that are perceived to be facilitating tax evasion face not only legal penalties but also the risk of divestment from ESG-focused funds, which now manage trillions of dollars in global assets.

Global comparisons illustrate the scale of the challenge facing the banking industry. In Germany, the "Cum-Ex" scandal has led to numerous criminal convictions of bankers, lawyers, and tax advisors, as well as the collapse of several smaller financial institutions. The German government has recovered billions, but the legal proceedings are expected to continue for another decade. In contrast, the French approach via the CJIP allows for a faster, albeit still expensive, resolution. This reflects a pragmatic strategy by French authorities to bolster the treasury while maintaining the stability of the Paris financial hub, which has seen a resurgence in the wake of Brexit.

The role of technology in these investigations cannot be understated. Modern tax authorities are increasingly utilizing sophisticated data analytics and AI-driven tools to identify patterns of share trading that coincide with dividend dates. The ability of regulators to process vast quantities of transaction data across multiple jurisdictions has made it much harder for banks to hide "Cum-Cum" trades within the high-frequency noise of the equity markets. As transparency increases, the window for such arbitrage strategies is rapidly closing.

Looking ahead, the financial services industry must navigate a landscape where the boundary between legal tax planning and illegal tax evasion is more strictly policed than ever before. The HSBC settlement in France is a clear signal that the era of "don’t ask, don’t tell" in dividend trading is over. Financial institutions are now being held to a standard of "beneficial ownership" where they must prove that a transaction has a legitimate commercial purpose beyond the mere avoidance of tax.

As the PNF continues its work, the focus may shift to the individuals who designed and approved these schemes. While the CJIP settles the liability for the corporate entity, it does not necessarily grant immunity to the executives involved. This remains a significant point of concern for the banking community, as the personal stakes for senior management continue to rise in tandem with corporate fines.

Ultimately, the €300 million agreement between HSBC and the French state is a watershed moment in the post-pandemic regulatory environment. It reaffirms the power of national prosecutors to challenge the complex machinery of global finance and serves as a reminder that the costs of historical non-compliance are both inevitable and substantial. For the broader market, it is a call to action to accelerate the adoption of transparent, ethically grounded tax strategies that can withstand the scrutiny of an increasingly vigilant global regulatory regime.