The manufacturing prowess of China in the production of omnibuses, a category encompassing a wide array of buses and coaches, is reshaping global transportation networks and influencing market dynamics for vehicle manufacturers worldwide. While specific, up-to-the-minute production figures are often proprietary and subject to commercial access, the sheer scale of China’s industrial output in this sector is undeniable, positioning it as a critical hub for both domestic consumption and international export. This dominance is not merely a matter of quantity but also reflects a strategic evolution in China’s automotive industry, moving towards higher value-added products and technological sophistication in public and commercial transport solutions.

The omnibus market, a broad segment that includes city buses, intercity coaches, touring vehicles, and increasingly, specialized transit solutions like electric buses, is a significant indicator of a nation’s commitment to modernizing its infrastructure and addressing urban mobility challenges. China’s rapid urbanization and the subsequent surge in demand for efficient public transportation have been primary drivers for its domestic bus manufacturing industry. Major Chinese manufacturers, such as Yutong, King Long, Higer, and BYD, have not only captured a substantial share of their domestic market but have also aggressively expanded their international footprint. These companies are not simply producing basic transport vehicles; they are investing heavily in research and development, particularly in areas such as new energy vehicles (NEVs), autonomous driving technology, and intelligent connectivity.

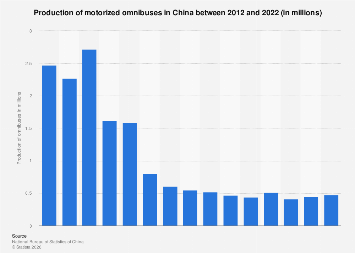

Statistics, when available, consistently highlight China’s leading position. While precise, real-time production numbers are typically part of premium data offerings from market research firms, industry reports and trade data from organizations like the China Association of Automobile Manufacturers (CAAM) regularly indicate a significant volume of bus and coach production. This output often surpasses that of other major manufacturing nations combined, underscoring a strategic industrial policy that has prioritized the development of a robust domestic automotive sector, including the specialized segment of large passenger vehicles. The growth trajectory of Chinese omnibus production has been steep, particularly over the last two decades, fueled by government incentives, a vast domestic market, and a proactive approach to technological adoption.

The economic implications of China’s omnibus production are far-reaching. Domestically, it supports a massive industrial ecosystem, creating jobs, fostering innovation, and contributing significantly to the country’s manufacturing GDP. The development of electric buses, for instance, aligns with China’s ambitious environmental targets and its global leadership in NEV technology. BYD, a prominent player in this space, has become a world leader in electric vehicle production, including electric buses, which are now operating in cities across the globe, from Europe to South America. This transition to electric and cleaner energy solutions is not just an environmental imperative but also a strategic move to gain a competitive edge in a rapidly evolving global automotive market.

Globally, Chinese omnibus manufacturers are increasingly challenging established players from Europe, North America, and other parts of Asia. Their competitive pricing, coupled with improving quality and technological advancements, makes them attractive partners for countries seeking to upgrade their public transport fleets, especially in developing economies. The Belt and Road Initiative, China’s ambitious global infrastructure development strategy, has also provided further opportunities for Chinese bus manufacturers to secure large contracts and establish a presence in new markets. This expansion often involves not just the sale of vehicles but also the transfer of technology and the establishment of local assembly plants, further embedding Chinese manufacturing capabilities into the global supply chain.

The market for omnibuses is not monolithic; it is segmented by application, technology, and price point. Chinese manufacturers have demonstrated an ability to cater to a wide spectrum of these segments. In the mass transit sector, their city buses, often electric, are becoming a common sight in urban centers worldwide. For long-distance travel and tourism, their coaches are also gaining traction, competing on features, comfort, and safety. The increasing focus on intelligent transportation systems, where buses are equipped with advanced navigation, passenger information systems, and connectivity features, is another area where Chinese firms are investing heavily, seeking to offer integrated solutions rather than just vehicles.

Market data, while often behind paywalls, indicates that China’s share of global bus production has steadily increased. For example, in the electric bus segment, China is undeniably the dominant force, accounting for a vast majority of the global production and deployment of these vehicles. This dominance is supported by strong government subsidies and policies that have encouraged domestic adoption and manufacturing. Looking at broader commercial vehicle data, the bus and coach segment forms a crucial part of China’s automotive export strategy, complementing its leadership in passenger cars and trucks.

Expert analyses often point to a confluence of factors driving this Chinese ascendancy. These include economies of scale inherent in serving a massive domestic market, aggressive government support for the automotive sector, a rapidly advancing technological base, and a willingness to invest in long-term market penetration. Furthermore, the agility of Chinese manufacturers in adapting to market demands and integrating new technologies has been a key differentiator. For instance, the rapid development and deployment of electric bus technology showcase their ability to respond swiftly to global trends and policy shifts towards decarbonization.

The competitive landscape is becoming increasingly dynamic. While European manufacturers like Mercedes-Benz (Daimler Buses), Volvo Buses, and MAN have a long-standing reputation for quality and innovation, they are facing intense pressure from Chinese rivals on both price and market share, particularly in emerging markets. North American manufacturers, while strong in their domestic markets, have also seen Chinese brands make inroads, especially in fleet sales for public transit agencies. The strategy of Chinese companies often involves offering a compelling value proposition, combining competitive pricing with increasingly sophisticated technology and after-sales support.

The long-term implications of China’s dominance in omnibus production extend beyond the automotive industry itself. It signifies a broader shift in global manufacturing power and technological leadership. As China continues to push the boundaries in areas like electrification, autonomous driving, and smart mobility, its influence on the future of public transportation and urban planning will only grow. Countries and regions around the world are increasingly looking to China not just as a supplier of vehicles but as a source of innovative solutions for their transportation challenges. This trend is likely to continue, with Chinese omnibus manufacturers playing an increasingly pivotal role in shaping the way people move in cities and across countries in the decades to come. The ongoing investment in advanced manufacturing techniques and sustainable transportation technologies suggests that China’s influence in this critical sector is set to endure and potentially expand further.