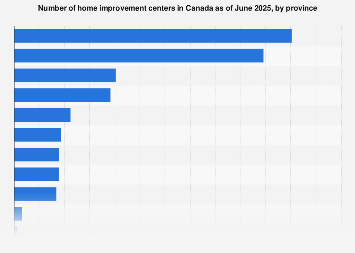

As of June 2025, Canada’s home improvement retail landscape is projected to encompass a substantial number of establishments, reflecting the sector’s enduring appeal and adaptation to market dynamics. While precise figures for all provinces and territories are subject to proprietary data access, available insights indicate a significant concentration of these retail outlets in key economic hubs, with Ontario historically leading the nation in terms of sheer store count. This provincial dominance is a common characteristic in large, diversified economies, where population density and economic activity are most pronounced. Conversely, territories such as Yukon typically exhibit a much smaller footprint in this sector, aligning with their lower population bases and unique logistical considerations.

The Canadian home improvement market, encompassing everything from lumber and hardware to paint, flooring, and specialized renovation services, has demonstrated resilience and growth over the past decade. This sustained performance can be attributed to a confluence of factors, including an aging housing stock requiring ongoing maintenance and upgrades, a growing interest in DIY projects fueled by accessible online content and social media trends, and a general increase in disposable income allocated towards enhancing living spaces. Furthermore, shifts in lifestyle, such as the increased prevalence of remote work, have prompted homeowners to invest more in creating comfortable and functional home environments, further stimulating demand for renovation and improvement products.

Looking at the broader retail context, the home improvement sector operates within a competitive environment. In 2022, The Home Depot stood out as the leading retailer in Canada, with sales exceeding $10 billion Canadian dollars. This demonstrates the significant market share commanded by major players, who leverage economies of scale, sophisticated supply chain management, and strong brand recognition to capture consumer attention. The success of such large entities often influences the strategies of smaller, independent retailers, pushing them to focus on niche markets, superior customer service, or specialized product offerings.

The geographical distribution of home improvement centers across Canada is not merely a reflection of population density; it also speaks to regional economic conditions and housing market trends. Provinces with robust construction activity and higher homeownership rates tend to support a greater number of these stores. Conversely, regions experiencing economic downturns or a higher proportion of rental properties might see a more constrained market. The consistent demand for home maintenance and renovation is a bedrock of this industry, providing a level of stability even during broader economic fluctuations.

Globally, the home improvement sector is experiencing similar trends. In the United States, the market is significantly larger, with major players like Home Depot and Lowe’s commanding substantial revenues. The dynamics observed in Canada – the importance of scale, the impact of DIY culture, and the influence of real estate markets – are mirrored internationally. Emerging markets are also witnessing growth in this sector as disposable incomes rise and urbanization drives demand for new housing and subsequent renovations.

The economic impact of the home improvement sector extends beyond retail sales. It is a significant employer, providing jobs in retail operations, logistics, warehousing, and often, skilled trades through affiliated services. The demand generated by renovations and improvements also stimulates upstream industries, including manufacturing of building materials, furniture, and appliances. Furthermore, investments in home improvement can positively impact property values, contributing to household wealth and overall economic stability.

Market analysts often point to several key drivers for the sector’s future trajectory. The aging demographic of Canadian homeowners means a continued need for accessibility modifications and maintenance. Millennial and Gen Z consumers, now entering their prime home-buying years, are increasingly interested in personalization and sustainable building practices, presenting opportunities for retailers to adapt their product assortments and marketing strategies. The integration of technology, from online sales and augmented reality visualization tools to smart home devices, is also reshaping how consumers engage with home improvement products and services.

While specific provincial breakdowns for June 2025 are not publicly detailed, the overarching trends suggest a continued, albeit potentially moderated, growth trajectory. Economic headwinds, such as inflation and rising interest rates, can influence discretionary spending on non-essential renovations. However, essential repairs and maintenance are less susceptible to these fluctuations. The industry’s ability to cater to both the budget-conscious DIYer and the homeowner seeking professional services will be crucial for sustained success. The ongoing evolution of consumer preferences, coupled with technological advancements and a persistent need for housing upkeep, positions Canada’s home improvement sector for a dynamic and adaptive future. The presence of established retail giants alongside a diverse array of smaller, specialized businesses ensures a competitive landscape that ultimately benefits consumers through choice and innovation.