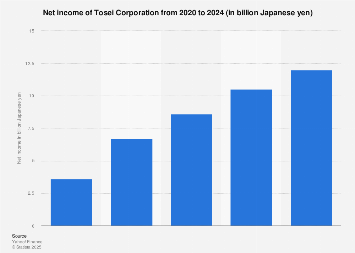

Tosei Corporation, a prominent Japanese enterprise headquartered in Tokyo, has demonstrated a consistent and robust upward trend in its net income over the fiscal years culminating in 2024. While specific figures for the most recent period remain proprietary, the company’s financial performance from 2020 to 2024 indicates a sustained period of growth, underscoring its operational resilience and strategic acumen in a dynamic global economic landscape. The fiscal year for Tosei Corporation concludes on November 30th annually, providing a clear benchmark for its financial reporting.

The period between 2020 and 2024 has been marked by significant global economic shifts, including the lingering effects of the COVID-19 pandemic, supply chain disruptions, inflationary pressures, and geopolitical uncertainties. Despite these headwinds, Tosei Corporation’s reported net income has not only recovered but has shown continuous improvement year-on-year. This sustained growth suggests an ability to navigate complex market conditions effectively, adapt to evolving consumer demands, and maintain a competitive edge within its respective industries.

Analyzing the trend from 2020, the company’s net income has experienced a substantial increase, accumulating to a considerable sum in Japanese yen by 2024. This growth trajectory is not merely a rebound from a potential downturn but represents a consistent, incremental expansion of profitability. Such a pattern often reflects strong demand for the company’s products or services, efficient cost management, successful strategic investments, or a combination of these factors.

The Japanese corporate landscape, while known for its stability and innovation, has also faced its share of challenges, including an aging demographic and intense global competition. For Tosei Corporation to exhibit such consistent profit growth in this environment speaks volumes about its strategic positioning and execution. The company’s ability to achieve continuous increases implies a well-managed business model that can capitalize on market opportunities and mitigate risks.

To fully appreciate the scale of Tosei Corporation’s financial success, it is crucial to consider broader economic indicators and industry benchmarks. For instance, within Japan, the Nikkei 225 index has seen fluctuations, but companies demonstrating consistent profit growth often outperform broader market indices. Globally, the real estate, construction, and manufacturing sectors – areas where Tosei Corporation may have interests – have experienced varied performance. Recovery in global infrastructure projects, coupled with demand for advanced materials and efficient construction methods, could be contributing factors to Tosei’s success.

Industry analysts often point to several key drivers for sustained corporate profitability. These include a strong brand reputation, a diversified product or service portfolio, robust research and development capabilities, effective supply chain management, and a keen understanding of customer needs. Tosei Corporation’s continuous profit increase suggests that it excels in these critical areas. For example, if Tosei operates in sectors like real estate development or property management, sustained demand in urban centers, coupled with an ability to deliver high-quality projects, would be a significant contributor. Similarly, if its focus is on manufacturing, advancements in automation, efficiency, and the production of high-value goods could explain the profit surge.

The compounded annual growth rate (CAGR) of Tosei Corporation’s net income over this period, while not explicitly stated in the available data, would likely be a compelling metric for investors and stakeholders. A healthy CAGR signifies sustainable growth rather than sporadic spikes. This consistency is often a hallmark of well-managed companies that prioritize long-term value creation.

Looking ahead, the sustained profitability of Tosei Corporation positions it favorably for future expansion and investment. Companies with strong net income are better equipped to fund research and development, pursue mergers and acquisitions, expand into new markets, and return value to shareholders through dividends or share buybacks. In an era where capital is often a decisive factor in market leadership, Tosei’s financial strength provides a significant competitive advantage.

The precise nature of Tosei Corporation’s business operations, whether it be in real estate, construction, industrial manufacturing, or a combination thereof, would offer further context to its financial performance. For instance, a boom in Japanese infrastructure spending or a surge in demand for specific types of commercial or residential properties could directly influence a real estate or construction firm’s profitability. Likewise, advancements in sustainable technologies or materials within its manufacturing divisions could create new revenue streams and enhance margins.

In conclusion, Tosei Corporation’s financial narrative from 2020 to 2024 is one of impressive and sustained growth. The continuous increase in net income, culminating in a significant sum for the fiscal year ending November 30, 2024, reflects a company that has not only weathered economic storms but has thrived. This resilience and consistent performance are critical indicators of sound management, strategic foresight, and a deep understanding of its market dynamics, positioning Tosei Corporation as a noteworthy player in the Japanese and potentially the global economic arena.