The global energy landscape underwent a seismic shift this week as financial markets reacted sharply to a sudden escalation in hostilities between Washington and Caracas. Following a decisive U.S. intervention targeting Venezuelan infrastructure and political stability, shares in major American petroleum corporations surged, reflecting a complex interplay of supply-side fears and a renewed "risk premium" on global crude benchmarks. On Wall Street, the energy sector emerged as the clear outlier in an otherwise cautious trading session, with the Energy Select Sector SPDR Fund (XLE) climbing significantly as investors recalibrated their portfolios to account for a potentially prolonged disruption in the Caribbean basin.

The immediate market reaction was characterized by a flight to domestic energy security. Major integrated oil companies, including ExxonMobil, Chevron, and ConocoPhillips, saw their valuations jump in the hours following the news. Analysts suggest that the rally is driven by two primary factors: the anticipation of higher global oil prices due to the removal of Venezuelan barrels from the market, and the strategic advantage gained by U.S.-based producers who are seen as "safe-haven" suppliers in an increasingly fractured geopolitical environment. While Venezuela’s oil production has been hampered for years by mismanagement and existing sanctions, it still sits atop the world’s largest proven crude reserves, making any direct military or aggressive economic "attack" a matter of grave concern for global supply chains.

The broader economic implications of this escalation extend far beyond the ticker tapes of the New York Stock Exchange. For the U.S. economy, the surge in oil prices presents a double-edged sword. While it bolsters the balance sheets of domestic drillers and service providers, it threatens to reignite inflationary pressures that the Federal Reserve has been struggling to contain. As West Texas Intermediate (WTI) and Brent crude benchmarks both trended upward, energy economists warned that the "fear premium"—the extra cost added to a barrel of oil due to geopolitical uncertainty—could persist for months. This premium often trickles down to the consumer level, impacting everything from the price of gasoline at the pump to the operational costs of transcontinental logistics.

Venezuela’s historical role in the energy market is one of untapped potential and systemic volatility. Despite possessing more than 300 billion barrels of proven reserves, the nation’s output has plummeted from a peak of over 3 million barrels per day in the late 1990s to a fraction of that in recent years. However, the prospect of a total shutdown or a regime-destabilizing event introduces a new level of unpredictability. Market participants are particularly focused on the Gulf Coast refining complex, which is uniquely calibrated to process the "heavy, sour" crude that Venezuela typically produces. A sudden vacuum in this specific grade of oil forces refiners to seek more expensive alternatives from the Canadian oil sands or the Middle East, further driving up the cost of refined products like diesel and jet fuel.

Expert insights from commodity strategists highlight the opportunistic nature of the current market rally. Many believe that the jump in U.S. oil shares is a speculative bet on the "re-shoring" of energy dominance. If Venezuelan supply is permanently sidelined or placed under stricter international control, the United States—now the world’s largest producer of crude oil thanks to the shale revolution—stands to consolidate its position as the primary guarantor of energy security for the Western Hemisphere. This geopolitical leverage is not lost on institutional investors, who are increasingly viewing domestic energy infrastructure as a vital component of national defense and economic stability.

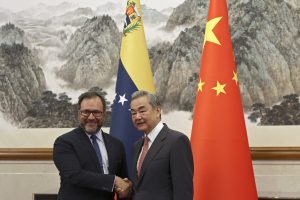

Furthermore, the escalation has prompted a re-evaluation of the "sanctions regime" as a tool of foreign policy. Critics of the intervention argue that aggressive maneuvers can lead to unintended consequences in the global commodities market, potentially pushing rivals like China and Russia closer together as they seek to secure their own energy interests outside of the U.S.-led financial system. From a market perspective, this creates a fragmented "two-tier" oil market where sanctioned crude trades at a deep discount to "transparent" Western barrels. The beneficiaries of this fragmentation are often the large U.S. independents who can ramp up production in the Permian Basin to fill the void left by disrupted foreign supply.

The impact on specific corporate entities has been profound. Chevron, for instance, has long maintained a complicated relationship with Venezuela, operating under special licenses to recoup debts through oil shipments. A direct attack or a tightening of the conflict puts these arrangements in jeopardy, yet the company’s stock rose alongside its peers, suggesting that the broader rise in oil prices outweighs the loss of specific regional assets. Similarly, ConocoPhillips, which has spent years pursuing multi-billion dollar legal claims against the Venezuelan government for the expropriation of its assets, is seen by some investors as a potential beneficiary of a regime change or a more aggressive U.S. posture that could lead to the eventual recovery of lost capital.

Global comparisons illustrate the unique position of the American energy sector. While European majors like BP and Shell also saw modest gains, their exposure to different geopolitical risks and a more aggressive pivot toward renewable energy has made them less sensitive to South American volatility compared to their American counterparts. The U.S. energy sector remains more closely tied to the "traditional" oil and gas model, making it a more direct play for investors looking to capitalize on fossil fuel price spikes. This divergence in strategy is becoming increasingly apparent as geopolitical flashpoints continue to underscore the world’s lingering dependence on hydrocarbons.

Looking ahead, the sustainability of this rally depends on the duration and intensity of the conflict. If the situation in Venezuela stabilizes quickly or leads to a rapid restoration of production under a new framework, the current price spike may prove to be a short-lived "sugar high" for energy stocks. However, if the intervention marks the beginning of a protracted regional struggle, the restructuring of global energy flows could be permanent. Analysts at major investment banks are already revising their year-end price targets for WTI, with some suggesting that a sustained period above $90 or even $100 per barrel is possible if the disruption spreads to neighboring transit routes.

The socio-economic impact on the Latin American region also cannot be ignored, as it directly influences the "sovereign risk" profiles of neighboring oil-producing nations like Guyana and Colombia. Guyana, which has recently emerged as an offshore oil powerhouse, finds itself in a precarious position as regional tensions rise. Investors are closely watching to see if the U.S. actions in Venezuela will provide a protective umbrella for these emerging markets or if the entire region will be branded as too volatile for long-term capital commitment. For now, the capital is flowing toward the perceived safety of the U.S. domestic market.

The Federal Reserve’s role in this scenario adds another layer of complexity. Higher energy prices are a primary driver of headline inflation. If the "attack" on Venezuela leads to a sustained increase in energy costs, it may force the central bank to maintain higher interest rates for a longer period to prevent a wage-price spiral. This creates a paradoxical situation where the energy sector thrives while the broader equity market struggles under the weight of tighter monetary policy. Investors are therefore balancing their "long energy" positions with a cautious outlook on consumer discretionary and manufacturing sectors, which are most vulnerable to rising input costs.

In summary, the surge in U.S. oil shares following the escalation in Venezuela is a stark reminder of the enduring link between geopolitics and global finance. While the immediate beneficiaries are the shareholders of American energy giants, the long-term consequences involve a fundamental reordering of energy alliances, a test of U.S. domestic production capacity, and a significant challenge for global inflation management. As the dust settles on the initial intervention, the market will remain hyper-fixated on every diplomatic cable and military movement, knowing that in the modern economy, the barrel of oil is as much a political instrument as it is a commodity. The rally in energy equities is not just a reaction to a news event; it is a calculated bet on a world where energy security is once again the ultimate currency of power.