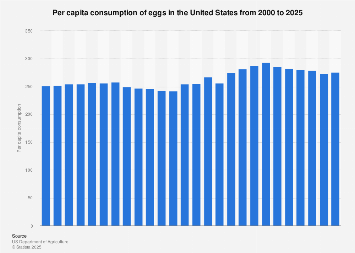

The trajectory of egg consumption in the United States indicates a sustained and robust demand, with per capita figures projected to climb further. In 2024, the average American consumed an estimated 272.9 eggs. This metric, calculated by subtracting exports from total domestic production and then dividing by the national population, is anticipated to reach 275.9 eggs per person by 2025, signaling a modest yet consistent increase in this staple food item’s popularity. This growth is occurring within a broader context of evolving consumer preferences and significant shifts in production methodologies across the vast American agricultural landscape.

While conventional caged systems continue to house the majority of the nation’s laying hens, there has been a discernible and accelerating expansion in the production of cage-free and organic eggs. This pivot reflects a growing consumer consciousness regarding animal welfare, ethical sourcing, and perceived health benefits associated with these alternative production models. Cage-free environments, while offering hens greater freedom of movement outside of confinement, can vary significantly in terms of space allocation and living conditions, sometimes leading to densely populated environments. Organic production, however, typically mandates that hens have access to outdoor ranges, aligning more closely with consumer expectations for natural and less intensively managed farming practices. This shift represents a substantial capital investment for producers and a complex logistical undertaking to meet the escalating demand for these premium egg categories. Market analysts observe that the premium pricing associated with organic and cage-free eggs, while initially a barrier for some consumers, is increasingly being accepted as a reflection of these enhanced welfare standards.

The United States egg industry has demonstrated a history of steady growth in overall production volume. For many years, the total number of laying hens in the U.S. mirrored this expansion, steadily increasing until a plateau was reached around 2019. Despite this slight pause in flock size growth, the efficiency and output per hen have continued to improve through advancements in feed formulations, hen genetics, and overall farm management. This sustained productivity has allowed the industry to meet rising consumption demands. Examining regional production hubs, Iowa has consistently maintained its position as the leading state for laying hen populations. As of 2022, the state housed an impressive approximately 43 million laying hens, underscoring its critical role in the national egg supply chain. Other significant egg-producing states include Ohio, Pennsylvania, and Indiana, forming a concentrated agricultural belt vital to the nation’s food security.

The economic implications of these trends are multifaceted. For the agricultural sector, the sustained demand for eggs translates into stable revenue streams for producers, fostering investment in infrastructure and technology. The shift towards cage-free and organic production, while potentially more costly upfront, opens new market segments and allows producers to capture higher margins. This can spur innovation in areas such as automated feeding systems, advanced climate control within barns, and sophisticated waste management techniques to minimize environmental impact. Furthermore, the growth in egg consumption contributes to the broader agricultural economy through demand for feed grains, packaging materials, and transportation services. The U.S. egg industry is a significant contributor to rural economies, providing employment opportunities and supporting ancillary businesses.

Globally, the United States ranks among the top egg-producing nations, alongside China and India. While per capita consumption varies significantly across different regions, driven by cultural dietary habits, economic development, and the availability of alternative protein sources, the U.S. figure places it within the higher tier of developed nations. For instance, countries in Southeast Asia and parts of Latin America exhibit high egg consumption due to eggs being an affordable and accessible source of protein. Conversely, some European nations, while having strong poultry sectors, may see slightly lower per capita consumption due to diverse dietary preferences and a greater emphasis on other protein sources like fish or dairy. The U.S. market’s projected growth suggests a continued strong performance relative to global averages, particularly in the premium segments.

The future of the U.S. egg market will likely be shaped by several key factors. Consumer preferences will continue to evolve, with an increasing focus on sustainability, traceability, and the nutritional profile of food products. The industry will need to adapt to further innovations in hen housing, feed composition to enhance egg quality and nutritional content, and potentially explore novel egg-based products. Regulatory landscapes, both domestically and internationally, concerning animal welfare and food safety will also play a crucial role in dictating production practices. Furthermore, global supply chain dynamics, including potential disruptions from avian influenza outbreaks or trade policies, will remain a critical consideration for producers and consumers alike. The ongoing investment in research and development within the U.S. egg industry is crucial for maintaining its competitive edge and ensuring it can meet the evolving demands of a dynamic global food market. The projected per capita consumption figures for 2025 are more than just numbers; they represent a continued reliance on eggs as a versatile, nutritious, and increasingly consciously sourced food product within the American diet.