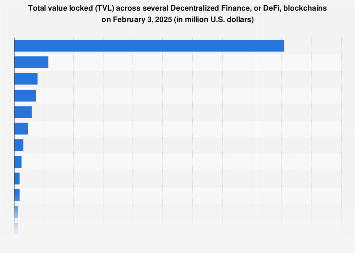

The decentralized finance (DeFi) sector, a burgeoning ecosystem built on blockchain technology, is projected to see substantial growth by September 2025, with Ethereum anticipated to maintain its commanding lead in total value locked (TVL). TVL serves as a critical benchmark, offering a proxy for the overall market size and adoption of DeFi protocols. This metric encapsulates the aggregate value of assets deposited into smart contracts, lending, borrowing, and staking mechanisms within the DeFi landscape.

The trajectory of the DeFi market in recent years has been nothing short of extraordinary. Throughout 2021, the total value locked witnessed unprecedented surges, far exceeding previous highs. This rapid expansion is intrinsically linked to the performance and capabilities of foundational blockchain networks. As the primary blockchain powering the vast majority of DeFi transactions and applications, Ethereum’s price action has a profound influence on the sector’s overall valuation. For instance, a notable price correction in Ether (ETH) on September 10, 2021, led to a significant, albeit temporary, dip of billions of U.S. dollars in Ethereum’s TVL, underscoring the direct correlation between the native cryptocurrency’s value and the locked capital within its DeFi ecosystem.

While Ethereum has historically been the undisputed leader, the DeFi landscape is becoming increasingly multi-chain. Projections for September 5, 2025, indicate a diversified yet still dominant Ethereum, with its TVL significantly outpacing the combined value locked across numerous other blockchain networks. This sustained leadership is attributed to Ethereum’s robust developer community, its established network effects, and the maturity of its DeFi infrastructure, including a wide array of decentralized exchanges (DEXs), lending protocols, and yield farming opportunities.

However, the growth of alternative Layer 1 blockchains and Layer 2 scaling solutions is gradually fragmenting the DeFi market. Networks such as Binance Smart Chain (now BNB Chain), Solana, Avalanche, Polygon, and Cardano have been actively attracting developers and users by offering lower transaction fees and faster confirmation times. These competing ecosystems have successfully onboarded significant capital, creating vibrant DeFi hubs with their own unique protocols and user bases.

Market analysis suggests that by mid-2025, while Ethereum’s dominance will persist, its share of the total DeFi TVL might see a slight moderation as these competing blockchains capture a larger portion of the market. This scenario is driven by several factors. Firstly, the persistent issue of high gas fees on the Ethereum mainnet, despite the ongoing upgrades and the implementation of Ethereum Improvement Proposals (EIPs) aimed at reducing these costs, continues to push users towards more cost-effective alternatives. Secondly, advancements in cross-chain interoperability protocols are making it easier for assets and users to move between different blockchains, thereby reducing network lock-in.

Consider the economic implications of this multi-chain expansion. The increasing competition fosters innovation, as each blockchain seeks to offer superior features and user experiences. This can lead to more sophisticated financial products, enhanced security measures, and greater accessibility for a broader range of investors. For instance, the rise of efficient automated market makers (AMMs) on platforms like Uniswap on Ethereum and PancakeSwap on BNB Chain has revolutionized token swaps. Similarly, lending protocols like Aave and Compound, originally built on Ethereum, have expanded to other networks, offering users more choices for earning interest on their crypto assets or borrowing against them.

The global adoption of DeFi is not uniform. Regions with greater technological infrastructure and a higher propensity for digital asset adoption are leading the charge. Emerging markets, however, present a significant growth opportunity. The ability of DeFi to offer financial services without traditional intermediaries could be particularly transformative in regions with underdeveloped banking sectors. Lower transaction costs on alternative blockchains are crucial for enabling micro-transactions and small-scale participation, which are essential for widespread adoption in these markets.

Expert insights highlight that the projected TVL figures by 2025 will be influenced by regulatory developments. Governments worldwide are grappling with how to regulate the DeFi space. Clarity on regulatory frameworks could either accelerate institutional adoption and further growth or introduce constraints that might slow down expansion. The ongoing dialogue between regulators and industry participants is a critical factor to monitor.

Furthermore, the evolution of Ethereum’s own infrastructure, particularly the transition to a Proof-of-Stake consensus mechanism (the Merge) and subsequent upgrades like sharding, is designed to significantly enhance its scalability and reduce transaction costs. These improvements are crucial for Ethereum to maintain its competitive edge and retain its dominant position in the long term. If these upgrades are successfully implemented and deliver on their promises, they could stem the outflow of capital to competing blockchains.

The statistical data, when fully accessible, will provide a granular view of the TVL distribution across these various blockchains. This would allow for a deeper analysis of which protocols and networks are gaining the most traction. For example, a significant increase in TVL on a particular blockchain might indicate the successful launch of a popular new DeFi application or a surge in demand for its native token. Conversely, a decline could signal user migration due to technical issues, competitive pressures, or unfavorable market conditions.

The total value locked, by its nature, is a dynamic metric, constantly fluctuating with market sentiment, technological advancements, and the introduction of new DeFi protocols. However, the trend towards a more diversified yet Ethereum-centric DeFi ecosystem by 2025 appears robust. This projected landscape underscores the ongoing maturation of decentralized finance, moving beyond speculative trading towards a more integrated and functional financial infrastructure. The interplay between established leaders like Ethereum and the innovative challengers will continue to shape the future of finance, offering new opportunities and challenges for investors, developers, and users alike. The continued growth and evolution of DeFi, as indicated by TVL projections, point towards a future where financial services are more accessible, transparent, and efficient, fundamentally reshaping global economic interactions.