The global market for pet products purchased online has undergone a dramatic and sustained expansion over the past decade, transforming from a niche segment into a cornerstone of the broader pet care industry. While initial figures from 2014 pointed towards a nascent but growing digital channel, contemporary analysis reveals a sector that has not only matured but has also become a primary driver of innovation and consumer engagement. This evolution is underpinned by a confluence of factors, including increasing pet ownership rates worldwide, a heightened humanization of pets, and the undeniable convenience and vast product selection offered by e-commerce platforms.

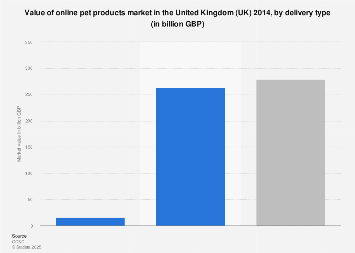

The foundational data from 2014, while limited in its immediate scope, served as an early indicator of the potential inherent in online retail for pet supplies. At that time, the digital marketplace was characterized by emerging e-commerce players and a gradual shift in consumer habits. However, the subsequent years witnessed an acceleration of this trend, particularly in developed economies where internet penetration and digital payment infrastructure were already robust. This period marked the true genesis of the online pet product market as a significant economic force.

Today, the online segment accounts for a substantial and growing share of the total pet care market, a sector valued in the hundreds of billions of dollars globally. Industry reports consistently highlight the double-digit growth rates of e-commerce within this vertical, often outpacing the growth of brick-and-mortar retail. This growth is not uniform across all product categories, with premium pet food, specialized dietary supplements, innovative pet technology (such as GPS trackers and automated feeders), and subscription box services experiencing particularly explosive demand online. The ability of online retailers to offer a wider array of brands, sizes, and specialized formulations than physical stores can typically stock has been a key differentiator.

The economic impact of this digital shift is multifaceted. For consumers, it has translated into greater accessibility, competitive pricing, and the ability to research products thoroughly before purchase. The convenience factor cannot be overstated, especially for busy households or individuals with limited mobility, who can have essential pet supplies delivered directly to their doorstep. This has democratized access to higher-quality and niche products that might otherwise be unavailable locally.

From a business perspective, the rise of online pet product sales has spurred significant investment in logistics, supply chain management, and digital marketing. E-commerce giants and specialized pet retailers alike have invested heavily in creating seamless online shopping experiences, from intuitive website design and mobile apps to efficient warehousing and last-mile delivery networks. This has also fostered the growth of smaller, direct-to-consumer (DTC) brands that leverage online channels to bypass traditional retail gatekeepers, allowing them to connect directly with pet owners and build strong brand loyalty. These DTC players often focus on specific market segments, such as organic food, hypoallergenic treats, or eco-friendly accessories, catering to increasingly discerning consumer preferences.

Market data from recent years illustrates the scale of this phenomenon. North America and Europe have historically led the charge in online pet product sales, driven by high disposable incomes and a strong cultural emphasis on pet companionship. However, the Asia-Pacific region, particularly China and Southeast Asian countries, is now emerging as a rapidly growing market. Factors such as increasing urbanization, a burgeoning middle class, and a growing acceptance of online shopping for a wide range of goods are fueling this expansion. Emerging markets are often leapfrogging traditional retail models, with consumers adopting e-commerce as their primary purchasing channel from the outset.

The COVID-19 pandemic served as a significant accelerant for the online pet product market. Lockdowns and social distancing measures forced many consumers to rely on e-commerce for their shopping needs, including pet supplies. This period saw a surge in new online shoppers, many of whom have since continued their digital purchasing habits due to the established convenience and expanded product offerings. Pet adoption rates also increased during the pandemic, further boosting demand for pet products across all channels, with online sales capturing a disproportionately large share of this incremental growth.

Expert analysis suggests that this growth trajectory is sustainable. The underlying demographic and societal trends that favor pet ownership and the humanization of pets show no signs of abating. Furthermore, ongoing technological advancements in e-commerce, including artificial intelligence for personalized recommendations, augmented reality for visualizing products, and faster delivery options, are expected to further enhance the online shopping experience and attract more consumers. The subscription model, where consumers can automate recurring purchases of essentials like food and treats, has proven particularly effective in building customer loyalty and predictable revenue streams for online retailers.

However, the online pet product market is not without its challenges. Intense competition among retailers, both established players and new entrants, can lead to price wars and pressure on profit margins. Ensuring efficient and cost-effective logistics, especially for bulky items like pet food, remains a critical operational hurdle. Moreover, while online channels offer convenience, some consumers still value the in-person experience of browsing products and seeking advice from knowledgeable staff at physical pet stores, particularly for more complex needs like veterinary diets or specialized equipment. The integration of online and offline channels, often referred to as omnichannel retail, is becoming increasingly important for businesses seeking to capture the full spectrum of consumer demand.

Looking ahead, the digital transformation of the pet product market is set to continue. Innovation in product development, driven by consumer demand for healthier, more sustainable, and technologically advanced options, will be a key differentiator. The data generated from online sales will provide invaluable insights for brands to tailor their offerings and marketing strategies, further personalizing the customer journey. As the global middle class expands and pet ownership continues to rise, the online channel is poised to remain the most dynamic and significant avenue for the sale of pet products worldwide, solidifying its position as a vital component of the global economy.