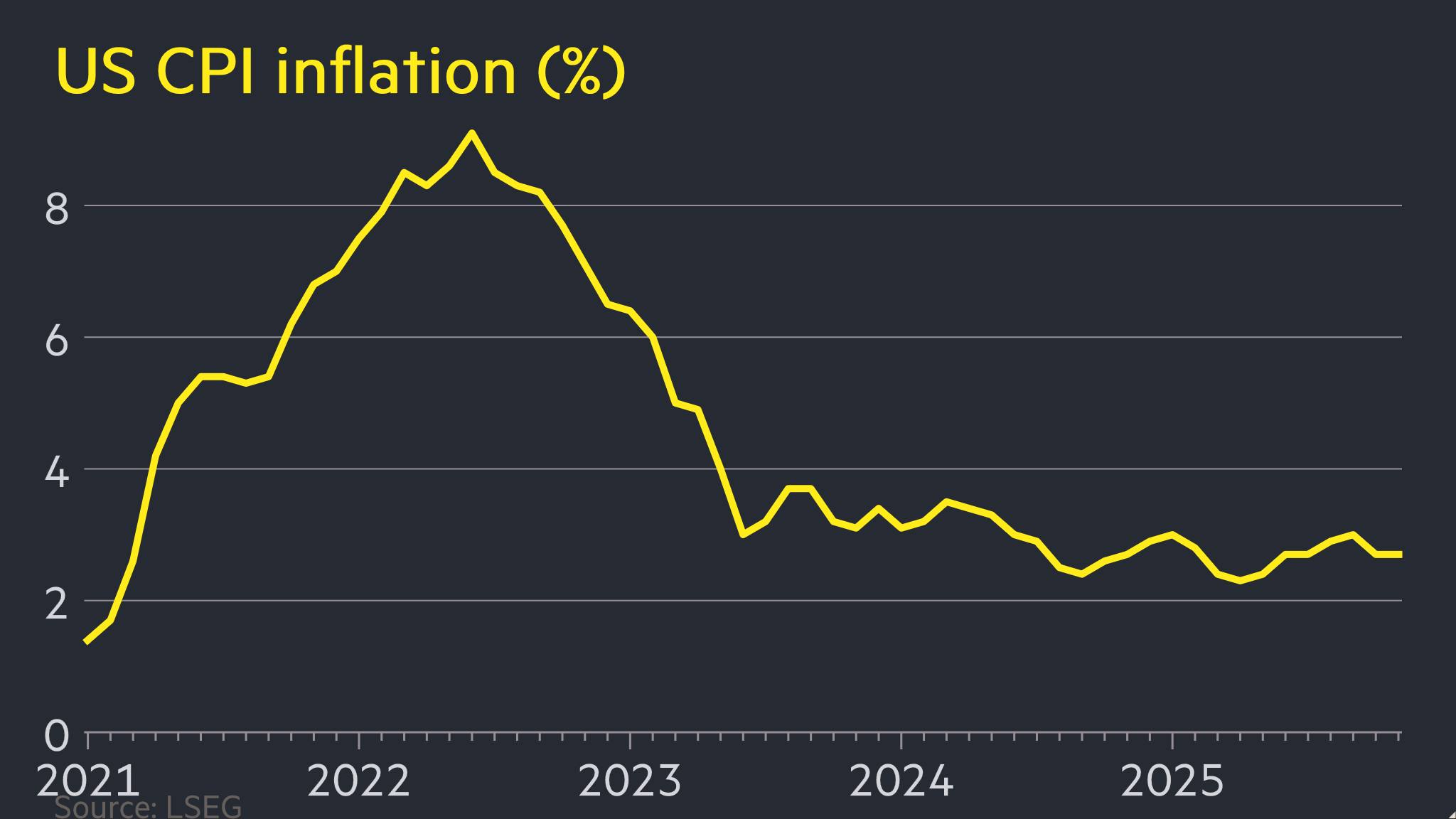

The latest economic data from Washington indicates that the United States’ battle against rising prices has entered a challenging plateau, with the annual rate of inflation holding steady at 2.7% for the month of December. This figure, which mirrors the pace observed in November, suggests that the rapid cooling of prices seen throughout the middle of the year has transitioned into a more stubborn, "sticky" phase. For the Federal Reserve, these figures represent a complex signal: while the hyper-inflationary peaks of 2022 are firmly in the rearview mirror, the final stretch toward the central bank’s long-standing 2% target is proving to be a slow and arduous journey.

This stagnation in the headline inflation rate underscores the resilience of the American economy, which continues to defy predictions of a significant slowdown despite the most aggressive monetary tightening cycle in four decades. The 2.7% reading reflects a confluence of diverging economic forces. On one hand, the stabilization of global supply chains and a retreat in energy costs from their post-invasion highs have provided significant relief to consumers. On the other hand, a robust labor market and high demand for services continue to exert upward pressure on prices, preventing a swift return to the price stability levels seen in the pre-pandemic era.

A granular analysis of the December data reveals that the "supercore" inflation metric—which strips out volatile food and energy costs as well as housing—remains a primary concern for policymakers. While goods deflation has been a primary driver of falling headline numbers over the last year, the cost of services ranging from healthcare and motor vehicle insurance to personal care remains elevated. Economists note that service-sector inflation is inherently linked to wage growth; as long as the labor market remains tight and workers demand higher pay to offset previous cost-of-living increases, service providers are likely to pass those costs on to the end consumer.

The housing sector, or "shelter" in inflationary parlance, also continues to play a disproportionate role in keeping the headline figure above the 2% threshold. Because of the way shelter costs are calculated—relying on existing lease renewals rather than real-time spot rents—there is a significant lag in the data. While private-sector trackers have shown a cooling in the rental market for months, these lower costs are only now slowly trickling into the official government reports. Until the shelter component of the index reflects the reality of a softening real estate market, headline inflation is expected to remain uncomfortably high for the Federal Open Market Committee (FOMC).

Market participants have reacted to the 2.7% print with a mixture of caution and recalibration. In the lead-up to the release, futures markets had begun pricing in an aggressive series of interest rate cuts beginning in the first half of the year. However, the lack of downward movement in the December data has forced a reassessment. Treasury yields saw a modest uptick following the announcement, as investors acknowledged that the Federal Reserve may need to maintain its "higher for longer" stance to ensure that inflation expectations do not become unanchored. The central bank’s current federal funds rate, sitting between 5.25% and 5.5%, is designed to be restrictive, but the 2.7% inflation reading suggests that the current level of restriction has yet to fully "break" the momentum of price increases.

The economic impact of persistent 2.7% inflation is felt most acutely by American households, particularly those in the middle- and lower-income brackets. While wage growth has finally begun to outpace inflation on a month-over-month basis, the cumulative effect of the last three years of price hikes has left a lasting mark on consumer sentiment. The cost of essential goods, while no longer skyrocketing, remains significantly higher than in 2020. This "vibecession"—a term coined to describe the gap between positive macroeconomic data and negative public perception—continues to influence consumer behavior. Retail sales data for the holiday season showed that while Americans are still spending, they are increasingly price-sensitive, opting for discount brands and delaying big-ticket purchases.

From a global perspective, the United States remains an outlier in its economic resilience. While the Eurozone has struggled with the specter of recession and the United Kingdom continues to battle much higher levels of core inflation, the U.S. has managed to sustain a "Goldilocks" scenario of moderate growth and cooling inflation. However, this divergence creates its own set of risks. A stronger-than-expected U.S. economy keeps the dollar robust, which can act as a drag on international trade and increase the debt-servicing costs for emerging markets that hold dollar-denominated debt.

The Federal Reserve’s leadership, including Chair Jerome Powell, has been consistent in its messaging: they require "greater confidence" that inflation is moving sustainably toward 2% before they consider easing policy. The December holding pattern at 2.7% provides little of that confidence. In fact, it raises the possibility of a "no landing" scenario, where the economy continues to grow and inflation remains stuck just above the target, forcing the Fed to keep rates high for an indefinite period. This scenario is particularly concerning for the commercial real estate sector and regional banks, which are sensitive to prolonged periods of high interest rates.

Expert insights suggest that the "last mile" of the inflation fight is often the most difficult. During the initial phase of disinflation, the economy benefits from the "low-hanging fruit" of resolving supply chain bottlenecks. Once those issues are resolved, further gains must come from a cooling of demand and a softening of the labor market—outcomes that the Fed has so far managed to avoid through a delicate balancing act. Some analysts argue that the 2% target itself may be outdated in a post-pandemic world characterized by "friend-shoring," an aging workforce, and the massive capital investments required for the green energy transition, all of which are structurally inflationary.

Looking ahead, the trajectory of inflation in the first quarter of the new year will be pivotal. If January and February data show a resumption of the downward trend, the Federal Reserve may still find a window to begin normalizing rates by mid-year. However, if inflation continues to hover near the 3% mark, the central bank risks losing credibility if it cuts rates too early, potentially sparking a second wave of inflation similar to the double-peak experienced in the 1970s.

Corporate earnings will also be a key indicator to watch. During the height of the inflationary surge, many companies were able to expand their profit margins by raising prices more than their input costs increased—a phenomenon some critics labeled "greedflation." As consumer resistance grows and inflation remains steady at 2.7%, firms are finding it harder to maintain those margins. The upcoming earnings season will reveal whether corporate America can continue to deliver growth in a "higher for longer" interest rate environment where pricing power is starting to wane.

In conclusion, the December inflation report of 2.7% serves as a stark reminder that the era of "easy" disinflation is likely over. The U.S. economy stands at a critical juncture, having successfully avoided a deep recession while bringing inflation down from 9% to under 3%. Yet, the final push to the 2% goal remains fraught with uncertainty. As the Federal Reserve weighs the risks of doing too much against the risks of doing too little, the stability of the global financial system hangs in the balance. For now, the narrative of a "soft landing" remains the base case, but the stubbornness of the December data suggests that the runway may be shorter, and the approach more turbulent, than many had hoped.