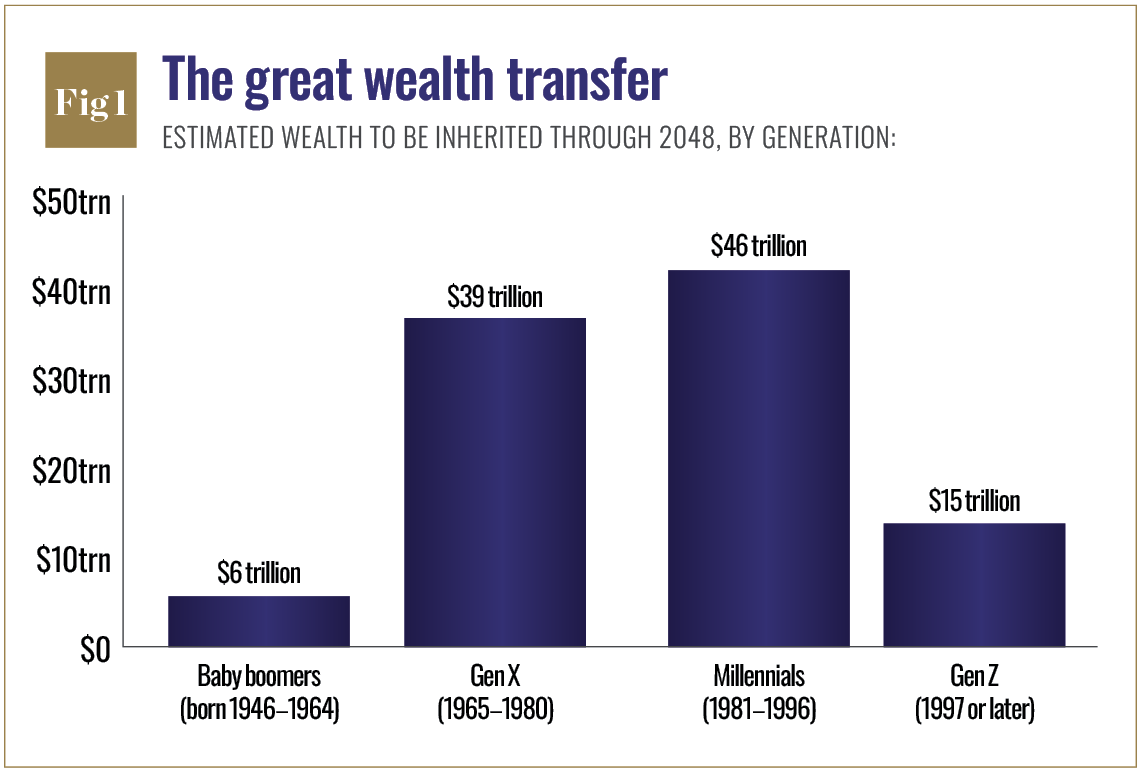

Over the next two decades, the global financial landscape is set to undergo its most significant intergenerational wealth transfer in recorded history. An estimated $124 trillion, accumulated by Baby Boomers and the Silent Generation, is projected to shift hands by 2048. This monumental reallocation of capital will not only reshape family fortunes and philanthropic endeavors but also fundamentally alter the operations of the financial services industry. More profoundly, however, this seismic shift heralds a cultural turning point, placing women at the forefront as primary inheritors and, crucially, as the central architects of financial decision-making.

The statistical reality of longevity is a key driver of this transformation. Women, on average, outlive men, meaning they are increasingly likely to inherit and manage substantial assets for extended periods. This demographic trend is recalibrating the very fulcrum of financial power. As Megan Wiley, CFP at Badgley Phelps Wealth Managers, observes, "With women holding more wealth for longer periods of time, their decisions have the potential to shape our economy more than ever before." This historic handover transcends mere economic redistribution; it represents a significant social and cultural inflection point, already influencing intergenerational dialogues about wealth, redefining client engagement strategies for financial advisors, and fostering a new perception of women as active stewards of significant capital.

A Generational Divide in Wealth’s Purpose and Perception

Recent market research, such as the Harris Poll report titled "The Great Wealth Transfer," offers critical insights into the prevailing attitudes shaping this era. Older Americans, aged 55 and above, predominantly view wealth as a cornerstone of security (42 percent) and a means to enhance their lifestyle and enjoyment (35 percent). In stark contrast, younger inheritors express a stronger emphasis on legacy-building (22 percent) and personal fulfillment (18 percent). Furthermore, this demographic exhibits a pronounced and growing inclination towards Environmental, Social, and Governance (ESG) principles and impact investing.

This generational divergence in financial priorities signals a profound shift in how capital will be deployed. Millennials and Gen Z are less inclined to view wealth merely as an asset to be passively held and grown; they are actively seeking to align their financial resources with their deeply held values and their aspirations for positive societal change.

While confidence levels appear high, with 64 percent of older Americans expressing trust in their heirs’ ability to manage wealth responsibly and 83 percent of heirs reporting self-assurance, an undercurrent of unease persists. Younger inheritors articulate significant concerns regarding taxation, the intricacies of legal frameworks, and the potential for asset mismanagement. Compounding these financial anxieties is an emotional burden encompassing guilt, grief, and anxiety, factors that older generations often underestimate. These multifaceted concerns have direct implications for financial institutions. A significant portion of heirs, precisely 43 percent, indicate their intention to switch financial providers post-inheritance, citing misaligned values and a perceived lack of personal connection with their current advisors. For wealth management firms, the imperative is clear: securing the next generation of clients will necessitate a strategic focus beyond mere investment performance, demanding instead the cultivation of trust, unwavering transparency, and a genuine alignment with clients’ evolving values.

Beyond Financial Literacy: The Cultural and Emotional Landscape of Inheritance

One of the most formidable obstacles confronting women in this wealth transition is not inherently financial but deeply cultural. For decades, societal norms often relegated daughters to the periphery of wealth-related discussions. Many grew up internalizing the passive assertion that "Dad handles the finances," a phrase that subtly reinforced the notion that financial management was outside their purview.

Michelle Taylor, a financial advisor at GFG Solutions, highlights this systemic issue: "All too often, heirs are looped in at the 11th hour, when the will has been written or after someone’s death. The fear of making a wrong move with family money can paralyse them into inaction." This pattern of delayed engagement can create a debilitating sense of unpreparedness. Nancy Butler, a financial planner with four decades of experience, elaborates on how historical silences perpetuate this cycle: "If your great-grandparents didn’t teach sound financial habits to your grandparents, and your grandparents didn’t pass them down, then your parents may not have been equipped to teach you. Without this chain of knowledge, each generation finds itself repeating the same mistakes." Conversely, families that foster open dialogue about financial matters tend to cultivate more confident heirs. As Allison Alexander of Savant Wealth Management succinctly puts it, "Families that talk about wealth transfer create heirs who thrive, not heirs who guess."

While today’s younger women may possess a higher degree of financial literacy than previous generations, this educational attainment does not automatically translate into preparedness for inheritance. "You can have all the content in the world, but unless you understand it and implement it, the confidence gap will still be present," states Taylor. Srbuhi Avetisian, Research and Analytics Lead at Owner.One, argues that a more critical deficit exists in "inheritance literacy." She notes, "Only seven percent of heirs in our global survey knew they typically have a three-to-six-month window to act before assets freeze. That window determines whether heirs – often daughters – retain access to their families’ lifestyle or lose it."

The administrative complexities surrounding inheritance represent another often-overlooked challenge. Joyce Jiao, CEO of Herekind, a digital estate administration platform, points out that financial literacy, while crucial for managing funds, does not equip individuals with the skills to navigate the intricate processes of probate, bank negotiations, funeral arrangements, and dependent care responsibilities, particularly while simultaneously processing grief. "Most often, the eldest daughter is the executor. Even highly educated women can feel overwhelmed and unprepared," Jiao observes. Money, especially when inherited, is rarely a purely transactional matter; it is frequently intertwined with profound emotional experiences such as grief, guilt, or a sense of unworthiness. Alexander emphasizes this duality: "An inheritance can carry grief as well as opportunity." In the absence of adequate support, these complex emotions can inadvertently lead to suboptimal financial decisions.

For many women, the emotional undercurrents associated with wealth are deeply ingrained. Transformational wealth coach Halle Eavelyn identifies common challenges: "Impostor syndrome is huge. Survivor’s guilt is common. And wealth, for many women, still feels dangerous – like it comes with a cost and can be taken away." Jiao echoes this sentiment in her work with executors, noting their role as an "emotional bridge – grieving, paying estate costs out-of-pocket, and making financial decisions that affect the entire family – all before they can even access their inheritance."

Adapting Advisory Services for a New Era of Wealth Holders

The financial advisory industry is beginning to acknowledge and adapt to these evolving dynamics. Historically, women were often viewed as secondary clients, but there is a growing recognition of their primary role as decision-makers. Taylor observes a shift in client priorities: "Women are happy to know the desired result will be achieved and give that more weight than the return they will achieve in a particular strategy." Wiley corroborates this trend, stating, "Clients want to see a holistic plan before making portfolio changes, allowing them to align investments with broader goals such as charitable giving." This evolution towards holistic, life-centric financial planning is paramount. Advisors who persist in focusing solely on products and returns risk alienating a generation that increasingly values impact, caregiving responsibilities, and legacy alongside traditional financial growth.

Technological advancements are also playing a significant role in reshaping the wealth transfer landscape. Interactive digital dashboards, inheritance simulation tools, and peer networks specifically designed for women are creating secure environments for learning and practicing financial decision-making prior to receiving inheritances. Avetisian suggests that "Institutions that run inheritance simulations – showing heirs what the first 90 days after a death look like – will build more confidence than any investment seminar."

As women increasingly inherit substantial wealth, they are actively redefining its purpose. Unlike previous generations, they are more inclined to perceive money not as an ultimate objective but as a potent instrument for achieving community impact, promoting sustainability, and solidifying family legacies. Eavelyn asserts, "When women control the purse strings, priorities change. Leadership gets more nuanced. Entrepreneurship gets more inclusive. Philanthropy shows up more. This isn’t just a transfer of wealth – it’s a paradigm change."

Kristin Hull, Founder and CIO of Nia Impact Capital, an Oakland-based firm specializing in impact investing with portfolios focused on sustainability, social justice, and gender diversity in leadership, highlights that the $124 trillion wealth transfer is positioning women as key decision-makers who demand transparency, purpose, and investments aligned with their values. She notes that while younger women are digitally adept and actively seek out tools and peer networks, significant gaps remain in inheritance literacy and emotional preparedness. Her most urgent recommendation is to mainstream gender-lens investing (GLI), integrating equity and impact metrics into the foundational frameworks of portfolio construction, estate planning, and wealth transfer processes.

This transformative trend is not geographically isolated. In Asia, women are projected to control nearly a third of investable assets by 2030. Similarly, in Africa and the Middle East, rising female entrepreneurship is accelerating wealth ownership. Nevertheless, persistent cultural and legal barriers remain. In certain regions, inheritance laws continue to favor male heirs, while in others, daughters encounter resistance in assuming financial leadership roles. For global financial institutions, the implications are unequivocal: this wealth transfer represents both a substantial opportunity and a critical stress test, necessitating the development of new frameworks that respect regional diversity while empowering women as primary decision-makers.

Addressing the Overlooked Opportunity: Cultivating Wealth Identity

Across expert opinions, a recurring theme emerges: the critical importance of timing. Far too often, women are integrated into wealth planning processes too late – typically after a death, when the confluence of grief and confusion collides with immediate financial responsibilities. Eavelyn identifies a crucial, yet frequently overlooked, opportunity: "The most overlooked opportunity is recognising that women need not just a wealth plan but a wealth identity. Until a woman sees herself as someone who is worthy of holding, growing, and enjoying her money, she stays stuck in fear and silence."

Proactive measures can fundamentally alter this trajectory. Strategies such as inviting heirs to annual family financial meetings, establishing mentorship programs, providing accessible "just-in-time" educational resources, and reframing financial conversations to emphasize values rather than solely numerical outcomes can significantly enhance women’s preparedness for wealth stewardship. These early interventions transform the concept of inheritance from a potentially disruptive windfall into a natural and integrated extension of life planning.

The $124 trillion wealth transfer represents more than a simple reallocation of assets; it signifies a profound cultural and economic paradigm shift. Women, poised to inherit and manage unprecedented levels of wealth, face a complex landscape of both challenges and opportunities. For financial institutions, the path forward is clear: survival and success in this evolving environment demand unwavering transparency, robust educational initiatives, and a fundamental recognition of women as the lead decision-makers they are becoming. Ultimately, whether this monumental transfer proves to be a burdensome undertaking or a catalyst for transformative progress will hinge on the collective ability of families, advisors, and institutions to rise effectively to the demands of this historic moment.