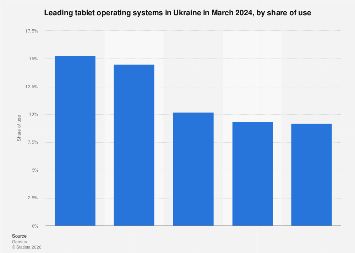

The digital device ecosystem in Ukraine, particularly within the tablet segment, is experiencing a dynamic shift in 2024, with established operating systems consolidating their positions while nascent contenders vie for market share. Analysis of recent data indicates a clear hierarchy of platform preference among Ukrainian consumers and businesses, reflecting broader global trends in mobile computing but also showcasing unique domestic nuances. This evolving landscape is shaped by factors ranging from device affordability and ecosystem integration to user interface familiarity and the availability of specialized applications crucial for both personal productivity and professional endeavors.

At the forefront of Ukraine’s tablet market, Android continues to assert its dominance, a trend consistent with its global supremacy in mobile operating systems. The sheer diversity of hardware options available at various price points, from budget-friendly models to high-end devices, makes Android tablets an accessible choice for a wide demographic. Manufacturers leveraging the Android platform – including global giants like Samsung, as well as prominent Chinese brands such as Xiaomi and Lenovo – offer a broad spectrum of features and specifications, catering to distinct consumer needs. This hardware variety, coupled with the open-source nature of Android, allows for extensive customization and a rich app store experience through the Google Play Store, which boasts millions of applications. The platform’s inherent flexibility and its deep integration with Google’s suite of services, from cloud storage to productivity tools, further solidify its appeal among Ukrainian users who increasingly rely on these integrated digital environments. The continued innovation in Android, with regular updates bringing enhanced performance, security, and user experience features, ensures its relevance in a rapidly advancing technological market.

However, the narrative of Ukraine’s tablet market would be incomplete without acknowledging the persistent presence and strategic importance of Apple’s iPadOS. While typically commanding a premium price segment, iPads have carved out a significant niche, particularly among users who prioritize a seamless ecosystem, robust performance for creative and professional tasks, and a highly curated user experience. The iPadOS, specifically designed for Apple’s tablet hardware, offers a fluid interface, powerful processing capabilities, and access to a dedicated App Store populated with applications optimized for the larger screen. For many Ukrainian professionals, students, and creatives, the iPad has become an indispensable tool for tasks ranging from graphic design and video editing to note-taking and digital art. The perceived durability, strong resale value, and the tight integration with other Apple devices like iPhones and MacBooks contribute to its enduring appeal, fostering a loyal user base that values consistency and premium quality. Despite the higher entry cost, the long-term value proposition and the perceived superior user experience continue to drive demand for Apple’s tablet offerings.

Beyond these two dominant players, the Ukrainian tablet market also sees a smaller, yet notable, presence of other operating systems. While Microsoft’s Windows has historically been a significant force in the computing world, its penetration in the tablet segment in Ukraine, as in many global markets, has been more targeted. Windows-powered tablets, often found in the form of 2-in-1 devices or convertibles, appeal to a specific segment of users who require a full desktop operating system experience for complex software applications, often in professional or enterprise settings. These devices bridge the gap between traditional laptops and tablets, offering the versatility needed for productivity-intensive tasks. The availability of powerful applications, enterprise-grade security features, and the familiarity of the Windows interface make these devices attractive for business users and those in specialized technical fields. However, the often higher price point and the less streamlined touch-first experience compared to dedicated tablet OSs can limit their broader consumer appeal.

Emerging trends suggest a growing interest in specialized operating systems or custom Android distributions tailored for specific use cases. As the tablet market matures, there is an increasing demand for devices optimized for niche applications, such as e-reading, digital signage, or industrial data collection. While these may not represent significant percentages of the overall market, they highlight a growing segmentation and a demand for highly specialized computing solutions. Furthermore, the ongoing geopolitical situation and its impact on supply chains and consumer spending patterns can influence the adoption rates of different operating systems. The affordability and accessibility of Android devices, for instance, may see increased traction in times of economic uncertainty, while premium devices might experience more moderate growth.

The economic implications of these operating system preferences are substantial. The dominance of Android, with its open ecosystem, fosters competition among hardware manufacturers, potentially leading to more competitive pricing for consumers. It also supports a vibrant app development community, driving innovation and providing a wide array of digital services. For Ukrainian developers, targeting the Android platform offers the largest potential user base. Conversely, the strong presence of iPadOS indicates a market segment willing to invest in premium hardware and software, which can stimulate higher-value transactions and support industries that rely on high-performance mobile computing, such as creative arts, education technology, and professional services. The sustained demand for Windows tablets in specific sectors underscores the continued importance of traditional computing power and the need for versatile devices in the business environment.

Looking ahead, the interplay between hardware innovation, software development, and evolving consumer needs will continue to shape Ukraine’s tablet operating system landscape. The increasing convergence of mobile and desktop computing, the rise of artificial intelligence capabilities integrated into operating systems, and the ongoing demand for secure and efficient digital solutions will all play a role. While Android and iPadOS are likely to maintain their leading positions, the market’s ability to adapt to new technological paradigms and cater to specialized demands will be key for any platform seeking to gain or expand its foothold in this dynamic digital arena. The Ukrainian market, with its unique economic and social characteristics, will undoubtedly offer a compelling case study in how global technology trends manifest and adapt within a specific national context.