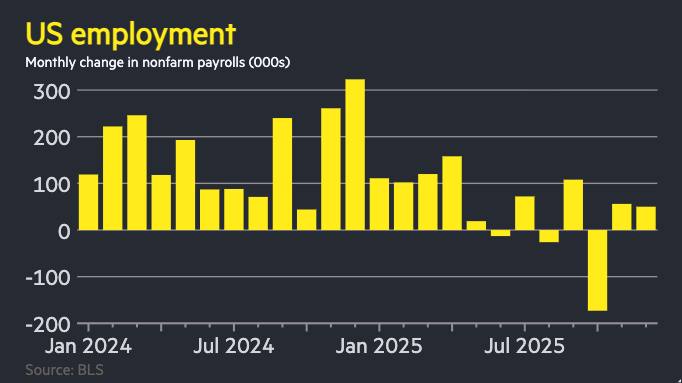

The United States economy closed the final month of the year on a surprisingly somber note, as nonfarm payrolls expanded by a mere 50,000 positions in December. This figure represents a dramatic deceleration from previous months and falls significantly short of the consensus estimates prepared by Wall Street analysts, who had generally forecasted a gain in the neighborhood of 150,000 to 175,000 jobs. The stark undershoot has sent ripples through global financial markets, prompting a re-evaluation of the American economic trajectory and raising fresh questions regarding the Federal Reserve’s next moves in its protracted battle against inflation.

This lackluster performance in the labor market marks one of the weakest periods of job creation since the recovery began following the pandemic-induced shocks. While the headline unemployment rate remained relatively stable due to a concurrent shift in labor force participation, the underlying data suggests a cooling trend that may be more aggressive than policymakers had initially anticipated. Economists are now scrutinizing whether this slowdown is a temporary seasonal anomaly or the beginning of a more profound structural shift in the domestic economy as the cumulative weight of high interest rates begins to take a visible toll on corporate hiring appetites.

The divergence between expectations and reality in the December report can be attributed to several overlapping factors. Chief among them is the exhaustion of the post-pandemic "catch-up" hiring phase, particularly in service industries that had previously been the primary engines of growth. Furthermore, the manufacturing sector continued to face headwinds from a softening global demand environment and a strong dollar, which has made American exports less competitive abroad. In the retail sector, which typically sees a surge in temporary staffing during the holiday season, the gains were notably more muted than in previous years, reflecting a shift in consumer behavior and a cautious approach by major retailers facing uncertain inventory cycles.

From a sectoral perspective, the December data revealed a fragmented landscape. While healthcare and social assistance continued to provide a baseline of stability—adding a modest number of roles to accommodate an aging population—other sectors that were once stalwarts of growth showed signs of stagnation. The professional and business services sector, often viewed as a bellwether for the broader economy, saw flat growth, suggesting that companies are increasingly hesitant to commit to new projects or permanent headcount in the face of macroeconomic uncertainty. Construction, meanwhile, remained sensitive to the prevailing interest rate environment, with new residential projects slowing as mortgage rates remained elevated, despite recent marginal retreats.

The Federal Reserve now finds itself in an increasingly delicate position. For much of the past two years, the central bank’s Federal Open Market Committee (FOMC) has maintained a hawkish stance, prioritizing the suppression of inflation through a series of aggressive rate hikes. However, the Fed operates under a "dual mandate" that requires it to balance price stability with maximum sustainable employment. The December jobs miss provides the first clear evidence that the "maximum employment" side of that equation may be coming under threat. If hiring continues to stall, the risk of a "hard landing"—a recession triggered by overly restrictive monetary policy—becomes a more tangible concern for investors and policymakers alike.

Market reactions to the report were immediate and telling. Yields on the 10-year Treasury note saw a downward adjustment as traders bet that the Federal Reserve might be forced to accelerate its pivot toward interest rate cuts in the coming year. Equity markets displayed a complex mix of volatility; while some investors welcomed the prospect of lower rates, others were spooked by the implications of a weakening consumer base. If the labor market loses its momentum, the primary engine of the U.S. economy—consumer spending—could falter, leading to a downward spiral in corporate earnings and broader GDP growth.

In a global context, the U.S. labor market’s deceleration mirrors trends observed in other major economies, though the American slowdown has its own unique characteristics. In the Eurozone, hiring has been hampered by persistent energy costs and a manufacturing slump in industrial powerhouses like Germany. In China, the transition away from a property-led growth model has created its own set of labor market challenges. The U.S., which had long been viewed as the "cleanest shirt in the laundry" among developed nations, is now showing that it is not immune to the synchronized global cooling. This synchronicity suggests that the era of easy growth is firmly in the rearview mirror, replaced by a period of cautious consolidation.

Expert insights into the December figures suggest that wage growth dynamics will be the next critical metric to watch. Despite the tepid hiring numbers, average hourly earnings have remained somewhat resilient, as employers remain loath to part with skilled workers in a labor market that still feels "tight" in specific specialized niches. This phenomenon, often referred to as "labor hoarding," occurs when firms maintain their current staff despite slowing demand, fearing the difficulty of rehiring once the economy rebounds. However, if the hiring slump persists into the first quarter of the new year, this resilience may break, leading to a more traditional cycle of layoffs and reduced consumer confidence.

The demographic shifts within the report also warrant attention. Participation rates among prime-age workers showed a slight dip, indicating that some individuals may be opting out of the workforce or facing barriers to re-entry that the current economic climate is failing to address. This is particularly concerning for long-term productivity growth, which relies on a robust and active labor force. Furthermore, the "underemployment" rate—which includes those working part-time for economic reasons—saw a marginal uptick, suggesting that even for those who are employed, the quality and consistency of work may be degrading.

As the new year begins, the 50,000-job figure serves as a sobering reminder of the volatility inherent in the current transition period. Economic forecasting has become notoriously difficult in an era defined by geopolitical tensions, shifting supply chains, and the rapid integration of artificial intelligence into the workplace. Some analysts argue that the December miss is a "noisy" data point, skewed by unusual weather patterns or late-season reporting lags. Others, however, see it as the definitive "canary in the coal mine," signaling that the cumulative impact of the most aggressive tightening cycle in forty years is finally biting deep into the real economy.

Looking ahead, the focus of the economic community will shift toward the upcoming earnings season and the January jobs report to see if December was an outlier or a trend. If the January numbers fail to show a significant rebound, pressure on the Federal Reserve to provide a more accommodative environment will become immense. Political considerations will also likely play a role, as a cooling economy becomes a central theme in the domestic discourse.

The impact on the average American household cannot be overstated. While lower inflation is a welcome development for purchasing power, it offers little comfort if job security is compromised. The "wealth effect" that fueled spending during the post-pandemic years is already being eroded by higher borrowing costs and the depletion of excess savings. A stagnant labor market would remove the final pillar supporting the current expansion.

Ultimately, the December employment report highlights the precarious balance of the modern global economy. The transition from an era of high inflation and rapid growth to one of stability and moderation is proving to be a turbulent journey. For now, the U.S. economy remains on a growth footing, but the margin for error has narrowed significantly. The 50,000 jobs added in December represent more than just a missed statistic; they represent a warning that the path to a "soft landing" remains fraught with obstacles that will require nimble policy responses and a resilient private sector to overcome. As the world watches the Federal Reserve’s next move, the reality of a cooling labor market has firmly taken center stage in the global economic narrative.