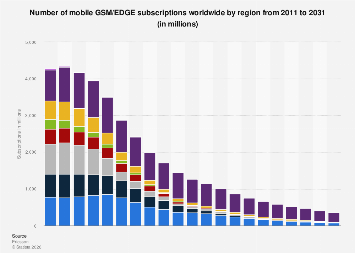

The global mobile telecommunications landscape is in a state of perpetual evolution, driven by relentless innovation and an insatiable demand for faster, more capable connectivity. While the spotlight often shines on the rapid expansion of 5G networks and the promise of future technologies like 6G, a significant portion of the world’s mobile subscribers still rely on foundational technologies. Projections indicate that by 2031, a substantial, albeit diminishing, number of mobile subscriptions worldwide will continue to operate on the Global System for Mobile Communications (GSM) and its enhanced data variant, General Packet Radio Service (GPRS), often referred to collectively as GSM/EDGE. This enduring presence, even as newer generations of mobile technology gain traction, highlights critical considerations for network operators, device manufacturers, and consumers across diverse economic strata.

While precise, granular figures for GSM/EDGE subscriptions by 2031 require access to proprietary market intelligence, industry analysis and historical trends provide a clear trajectory. The continued existence of these older network generations is not a testament to their advanced capabilities, but rather a reflection of market segmentation, economic realities, and the staggered pace of technological adoption. In many developing economies, where the cost of devices and services is a primary concern, GSM/EDGE networks remain the most accessible and affordable option for basic mobile communication. This includes voice calls and simple text messaging, services that are fundamental to daily life and economic activity for billions.

The market for GSM/EDGE is bifurcated. On one hand, it represents a legacy infrastructure that many advanced economies are actively decommissioning to reallocate spectrum for 4G and 5G services. Countries like the United States, South Korea, and several European nations have already phased out or are in the process of shutting down their 2G and 3G networks, a trend that will accelerate. This strategic reallocation allows for more efficient spectrum utilization, enabling higher data speeds and lower latency for newer technologies. However, this decommissioning process can pose challenges for users of older devices and in regions where 4G/5G coverage is still nascent.

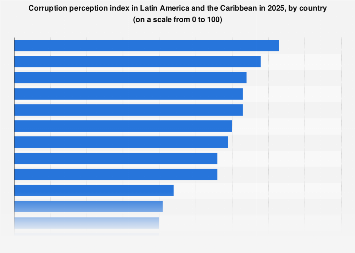

Conversely, in large parts of Africa, South Asia, and some Latin American countries, GSM/EDGE networks continue to serve as the backbone of mobile connectivity. According to various industry reports, a significant percentage of mobile connections in these regions are still based on 2G technology. This is due to several factors: the lower cost of 2G-enabled feature phones, which are prevalent in these markets; the reliability of these networks for basic services; and the substantial investment required to deploy and maintain advanced 4G and 5G infrastructure across vast, often rural, territories. The economic disparity between developed and developing nations plays a crucial role in this staggered adoption cycle. A smartphone capable of accessing the latest mobile broadband technology can represent a significant portion of a household’s income in some markets, making feature phones the practical choice for many.

The economic implications of this prolonged reliance on GSM/EDGE are multifaceted. For mobile network operators, maintaining these legacy networks represents an ongoing operational cost, including spectrum licensing, maintenance of aging equipment, and power consumption. However, these networks also continue to generate revenue from a large subscriber base, particularly in emerging markets where Average Revenue Per User (ARPU) might be lower but the sheer volume of users is significant. The decision to maintain or decommission these networks involves a complex cost-benefit analysis, factoring in subscriber migration patterns, competitive pressures, and regulatory mandates.

Device manufacturers continue to produce GSM/EDGE-compatible devices, primarily feature phones and basic smartphones, to cater to the demand in these markets. This segment of the market, while less glamorous than the flagship smartphone segment, remains substantial. The longevity of GSM/EDGE also influences the ecosystem of associated services. For instance, mobile money platforms, which have revolutionized financial inclusion in many developing countries, often rely on the ubiquitous reach of 2G networks for their operation, sending and receiving transaction alerts via SMS.

As 2031 approaches, the global mobile subscription landscape will present a more complex picture than ever before. While the number of GSM/EDGE subscriptions is projected to decline significantly from current levels, they will not disappear entirely. The decline will be driven by the natural obsolescence of devices, the increasing affordability of 4G-enabled smartphones, and the strategic decisions of operators to consolidate their network infrastructure. Nevertheless, the enduring presence of GSM/EDGE subscribers underscores the persistent digital divide and the importance of ensuring universal access to mobile communication, even if it’s through older, more basic technologies.

The continued operation of GSM/EDGE networks also has implications for cybersecurity and network resilience. Older protocols may have inherent vulnerabilities that are more challenging to patch or mitigate compared to modern standards. Network operators must therefore continue to invest in security measures to protect these legacy systems from emerging threats. Furthermore, the spectrum occupied by 2G and 3G networks is a valuable resource. As it is gradually freed up, it can be repurposed for more advanced technologies, enhancing the capacity and efficiency of 4G and 5G networks. This process is a delicate balancing act, ensuring that the migration away from older technologies does not disenfranchise existing users.

The global comparisons in mobile technology adoption reveal stark contrasts. While countries like China and the United States lead in 5G deployment and adoption rates, with a substantial portion of their mobile user base already on advanced networks, other nations are still in the early stages of 4G rollout. In these contexts, the focus remains on bridging the 2G-to-4G gap before a full transition to 5G becomes a primary objective. The economic development of a nation often correlates directly with its mobile technology infrastructure. Countries with higher GDP per capita tend to have faster adoption rates of newer technologies, while lower-income countries often see a longer tail for older technologies.

Looking ahead, the gradual phasing out of GSM/EDGE will be a key indicator of global progress in digital inclusion and technological advancement. It signifies a move towards a more unified and capable mobile ecosystem. However, the challenges of ensuring equitable access to the benefits of advanced mobile technology will remain a critical focus for policymakers, industry leaders, and international organizations for years to come. The slow fade of GSM/EDGE is a narrative of uneven progress, economic disparity, and the enduring human need for connection in its most fundamental forms. The continued existence of these subscriptions, even as they dwindle, serves as a reminder of the diverse realities of the global digital economy.