Gold prices have surged to unprecedented levels, surpassing $4,000 per troy ounce by the second week of October 2025. This remarkable ascent, which has effectively doubled the commodity’s value in less than two years, is primarily fueled by a concerted effort among central banks to bolster their bullion holdings and a significant influx of capital into gold-backed investment funds. While there was a slight moderation in central bank gold accumulation during July 2025, the overarching trend indicates a profound re-evaluation of reserve asset allocation strategies across the globe.

The escalating geopolitical risks that have characterized the international landscape are widely cited as a principal driver behind central banks’ renewed interest in gold. This has led to a discernible pivot away from the U.S. dollar as the sole repository of value and a strategic diversification into the precious metal. Compounding this shift, the bond markets have experienced considerable volatility throughout the current year, further diminishing the appeal of traditional fixed-income assets. Financial analysts, such as those at Goldman Sachs, project even greater gains for gold, with some forecasts suggesting a potential reach towards $5,000 per ounce, particularly if geopolitical tensions intensify or if fiscal policies diverge significantly from established norms.

The prevailing sentiment among many economic observers is that central banks are grappling with a complex interplay of inflationary pressures and broader economic uncertainties. While the European Central Bank (ECB) has expressed optimism about its ability to manage inflation towards its 2% target in the medium term, citing headwinds from tariffs, a stronger euro, and increased global competition, the underlying anxieties appear to extend far beyond mere price stability. Christine Lagarde, President of the ECB, and Vice-President Luis de Guindos, acknowledged in a September 2025 press conference that while these growth impediments are expected to recede, the long-term implications of a shifting global policy environment remain a subject of close observation.

The rationale for this significant reallocation of assets is multifaceted, moving beyond conventional inflation hedging. Ugo Yatsliach, Founder of Gold Policy Advisor and an economics and finance professor, articulates a core concern: "Central banks aren’t just worried about inflation – they are worried about a world where dollar assets can be sanctioned, seized or devalued." This apprehension stems from the increasing "weaponization" of financial tools and the potential for sovereign assets to be unilaterally restricted or confiscated. Gold, in this context, offers a politically neutral and seizure-resistant alternative for reserve portfolios, mitigating the inherent vulnerabilities of dollar dependence. While U.S. Treasuries and dollar-denominated funding continue to play a role in global reserves, their dominance is being eroded by the rise of competing economic blocs, the development of parallel payment systems, and the ongoing realignment of global supply chains, all of which complicate traditional monetary policy frameworks.

The pervasive geopolitical and economic uncertainty has cemented gold’s position as a vital hedge, a strategic bulwark against unforeseen risks. Industry commentators interpret this growing central bank demand as a fundamental structural shift in global capital flows. The Official Monetary and Financial Institutions Forum (OMFIF) has observed that geopolitical events have created a fertile ground for gold to regain its prominence within central bank reserve portfolios, even suggesting its potential use in facilitating international payments for certain nations.

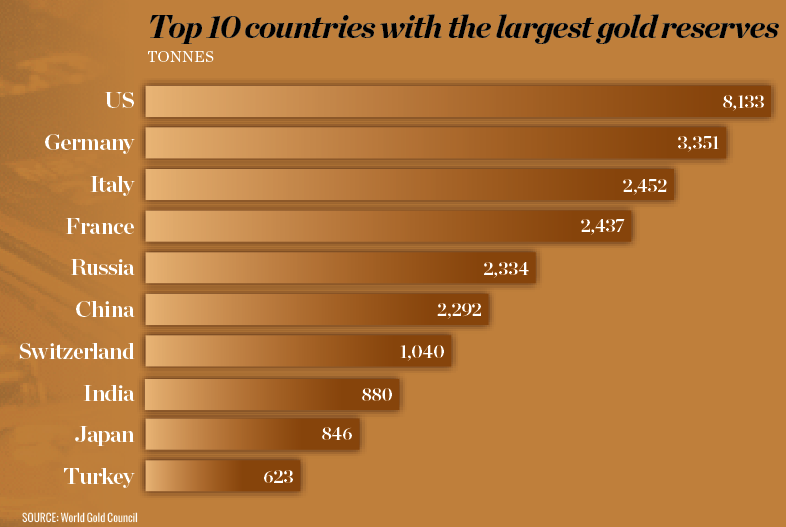

The first half of 2025 saw a substantial increase in gold acquisitions by central banks, with approximately 410 tonnes added – a figure 24% above the five-year average. Emerging markets have been at the forefront of this diversification away from dollar reserves, prompting advice for investors to allocate between 5% and 10% of their portfolios to gold, either through physical bullion or Exchange Traded Funds (ETFs). While persistent geopolitical risks support this strategy, investors are cautioned about potential short-term volatility driven by dollar strength and shifting policy landscapes.

A spokesperson for the European Central Bank confirmed that gold forms a part of its foreign reserves, acknowledging its "historical and strategic significance in reserve management." However, in line with typical central bank policy, further comment on specific market forecasts or the policies of other central banks was not provided.

Hugh Morris, Senior Research Partner at Z/Yen Group, highlights the historical anomaly of the current trend. "There is a definite reversal of an historic trend because up until recently central banks have been net sellers rather than net buyers of gold," he notes. The administration of U.S. President Donald Trump is seen as a significant catalyst, accelerating concerns about an over-reliance on the U.S. dollar. This has prompted a reassessment of currency dependence, a sentiment that predates the current political climate. Furthermore, the global security landscape has deteriorated, marked by ongoing conflicts and crises, such as those in Ukraine and the Middle East. In this environment, gold’s traditional role as a hedge against economic shocks and volatility has been amplified, offering a level of certainty unmatched by other asset classes. Morris also points to a "groupthink" phenomenon, where observing other central banks actively purchasing gold encourages participation to avoid being left behind.

For developing countries, gold holds particular allure as they seek to diversify their holdings and hedge against economic, geopolitical, and policy uncertainties. Michael Bolliger, Chief Investment Officer Emerging Markets at UBS Global Wealth Management, explains that emerging market central banks have been the largest buyers, seeking assets less correlated with the U.S. dollar and less sensitive to interest rate fluctuations. This persistent accumulation is expected to continue, as these institutions often prioritize gold as a stable store of value over short-term price sensitivity.

Bolliger attributes the recent surge in gold prices to several factors, including anticipation of further Federal Reserve interest rate cuts and persistent inflation. These conditions have driven down real interest rates in the U.S., making gold more attractive relative to interest-bearing assets. A weakening U.S. dollar, driven by expectations of accommodative Fed policy, further enhances gold’s appeal for non-dollar investors. Robust investor demand, evidenced by rising ETF holdings and strong central bank purchases, provides additional support. Despite a brief summer slowdown, these underlying drivers, coupled with elevated geopolitical risks and policy uncertainty, have propelled gold to new price plateaus.

Morris observes a departure from the historical inverse relationship between gold prices and interest rates. Traditionally, higher interest rates meant lower gold prices. However, the current environment features both relatively high interest rates and a high gold price, a phenomenon driven by a confluence of risk and uncertainty.

While some European central banks have been relatively inactive in their gold purchases, China has emerged as a significant buyer, alongside other central banks in Asia. Poland, for instance, has begun increasing its gold reserves, a move attributed to a proactive response to perceived systemic vulnerabilities. In contrast, historical patterns suggest that the Bank of England has at times divested gold at inopportune moments. China and Russia, being major gold producers, have a strategic advantage in accumulating the metal for their reserves. The U.S., despite expectations to re-evaluate its gold holdings, has seen its reserves remain largely unchanged, leading to ongoing scrutiny regarding the exact quantities held, particularly in facilities like Fort Knox. The historical narrative suggests that the U.S. significantly reduced its gold reserves post-World War II to support the dollar-gold convertibility system, a commitment that ultimately led to a depletion of its holdings and the eventual decoupling of currencies from gold in 1971. Since then, all fiat currencies have experienced a decline in value when measured against gold.

The ongoing accumulation of sovereign debt presents a critical challenge for fiscal sustainability. For example, the U.S. is operating with a substantial deficit, necessitating continuous borrowing. The cost of servicing this debt, including defense expenditures, represents a significant portion of government spending, potentially forcing a return to much lower, even zero, interest rates to manage the burden. This imperative is likely to drive central banks globally towards similar accommodative monetary policies. The prospect of the Federal Reserve resorting to quantitative easing (QE) to lower long-term rates, however, introduces further market nervousness, as it essentially involves an expansion of the money supply. This strategy, while potentially offering short-term relief, is viewed by some as a cure that could prove more detrimental than the ailment itself, reinforcing the appeal of gold as a prudent investment.

The erosion of confidence in traditional safe-haven assets, such as fixed-income instruments, is a key factor in the recalibration of global capital flows. This decline is largely attributed to the extraordinary debt levels prevalent in most Western economies. Investors are compelled to explore alternative avenues, including gold, cryptocurrencies, and real estate, as traditional portfolio allocations like the 60/40 stock-bond mix are being re-evaluated. The pool of truly safe assets appears to be diminishing.

The prevailing perception of heightened risk compared to market opportunities is a primary catalyst for this capital shift. Trade policies, such as U.S. tariffs, have disrupted companies previously focused on high-growth, high-value investments, particularly in developing economies. This has forced a reassessment of investment strategies. The economic philosophy often associated with "Trumponomics" is characterized by a zero-sum outlook, where perceived opportunities are finite, and gains for one party come at the expense of another. This contrasts with classical economic principles that emphasize expanding the overall economic pie. This win-lose perspective, driven by a belief in limited resources, informs policymaking and influences investment decisions.

While the specific policy decisions of any administration are a factor, the fundamental shift towards gold is also deeply rooted in the perceived "weaponization" of the U.S. dollar. The imposition of sanctions, notably in response to international conflicts, has served as a stark warning to nations worldwide, not just direct adversaries. Allies have come to understand the inherent risks of entrusting their financial stability to a single sovereign nation, marking a significant turning point in the global financial order. The trade disputes initiated by the U.S. administration have only amplified the incentive for central banks to diversify their holdings away from the U.S. dollar and U.S. Treasury securities.

Capital is demonstrably migrating from a strategy of "yield at any cost" to one prioritizing "resilience at all costs." The declining demand for U.S. Treasuries, coupled with dollar devaluation and escalating geopolitical tensions, renders paper assets increasingly risky. This environment drives financial institutions to seek the protective qualities of gold. Gold’s appeal intensifies when its role as a store of value surpasses its function as a medium of exchange. Its liquidity, independent of any single sovereign, and its steady demand from official institutions underscore its growing importance. When the pursuit of yield becomes secondary, capital naturally gravitates towards assets perceived as permanent, and gold fits this description.

China, a significant holder of U.S. Treasuries, has strategically reduced its holdings while simultaneously strengthening its gold reserves. This diversification aims to mitigate the risks associated with the potential weaponization of the U.S. dollar. The U.S. Federal Reserve’s independence has also come under scrutiny, with concerns that the executive branch seeks to exert greater influence over its policy decisions. This perception of the dollar being used as a political tool fuels the flight to gold, which is inherently politically neutral. Politics, in this context, acts as an accelerant for a diversification trend that was already underway.

The current administration’s efforts to reshape the global financial and economic landscape, particularly its persistent pressure on the Federal Reserve to lower interest rates, have generated unease among other central banks. Aggressive interest rate cuts in the face of building inflationary pressures could exacerbate economic instability. The global dissemination of U.S. policy shifts through the dollar, treasuries, and fund markets is closely monitored. Any perceived executive overreach in influencing the Fed’s governance or policy decisions introduces significant uncertainty into global markets. The fear is that the dollar, the bedrock of the global reserve system, could become driven by political agendas rather than market forces, diminishing its reliability.

Historical legislation, such as the Gold Reserve Act of 1934, transferred gold ownership from the Federal Reserve to the U.S. Treasury and established the Exchange Stabilization Fund (ESF). This fund grants the President and the Secretary of the Treasury broad discretionary powers to manage gold and foreign exchange, with their actions being final and not subject to review. The potential for a President to appoint individuals amenable to executive influence to key positions within the Federal Reserve could lead to unprecedented executive control over monetary policy. This would undermine the Fed’s independence, making it susceptible to the prevailing political agenda. Consequently, foreign central banks are increasingly prioritizing self-insurance, viewing gold as a crucial hedge against the politicization of the dollar and the potential volatility of dollar-denominated funding. This is a critical concern for institutions that borrow in dollars and rely on central bank swap lines for liquidity backstops.

The potential for contagion to spread through financial networks if the U.S. experiences economic turbulence, exacerbated by loosened oversight, is a significant risk. Volatility in core interest rates and the U.S. dollar can complicate monetary transmission mechanisms and re-ignite fragmentation risks within currency zones like the Euro Area. Trade policies can directly influence yields, currency values, and risk premiums, impacting the value of other central banks’ dollar reserves. When the anchor currency appears subject to political influence, gold becomes the universal insurance policy.

The question of whether gold can effectively navigate current geopolitical and economic risks better than the U.S. dollar and treasury bonds is a subject of ongoing debate. While gold is unequivocally an asset of choice during times of uncertainty, bonds and other interest-linked instruments may continue to offer attractive returns due to the prevailing levels of global risk. The current scenario of high interest rates and high gold prices is driven by these elevated risk levels, operating independently of each other.

In recent years, gold has demonstrated a strong performance relative to many other asset classes, including the U.S. dollar and U.S. Treasury bonds. As long as geopolitical concerns and political and policy risks remain paramount, gold is expected to continue outperforming traditional safe-haven assets. However, it is important to note that gold prices can also experience fluctuations during "risk-off" events, as investors may liquidate assets in favor of holding cash, typically in U.S. dollars.

The prediction of gold reaching $5,000 per ounce is viewed by some as a realistic scenario, with prices below $4,300 considered potentially undervalued given the current deficit and sovereign debt situation. The prospect of the Federal Reserve lowering interest rates is seen as a significant catalyst for further gold appreciation. The pace at which central banks engage in money printing or quantitative easing will be a key determinant of future gold price movements. Regardless of the specific trajectory, in an environment characterized by persistent uncertainty, investment in gold is likely to remain a strategic imperative.