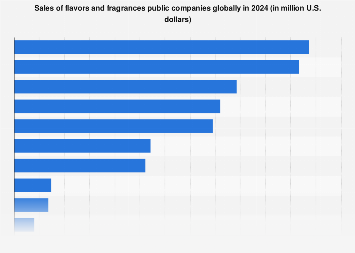

The global flavors and fragrances (F&F) industry is poised for a dynamic year in 2024, characterized by evolving consumer preferences, technological advancements, and a complex interplay of economic forces. This sector, a critical component of consumer goods, food and beverage, and personal care industries, is witnessing a sustained demand driven by innovation and an increasing consumer focus on sensory experiences. While specific sales figures for individual companies in 2024 are proprietary and subject to market fluctuations, the overarching trends point towards continued expansion, albeit with regional variations and sector-specific nuances. The market’s resilience is underpinned by its integral role in product differentiation and brand appeal across a vast array of consumer products.

The F&F market, valued in the tens of billions of dollars globally, operates on a foundation of intricate scientific formulation and creative artistry. Key players in this industry, from multinational conglomerates to specialized niche providers, are investing heavily in research and development to anticipate and shape consumer desires. This includes a growing emphasis on natural and sustainable ingredients, driven by heightened environmental consciousness and a demand for cleaner labels. Consumers are increasingly scrutinizing the origin and ethical sourcing of raw materials, prompting F&F companies to re-evaluate their supply chains and embrace greener practices. This shift not only addresses consumer concerns but also opens new avenues for premium product development and market differentiation.

Geographically, the F&F market exhibits diverse growth patterns. Emerging economies, particularly in Asia, are presenting significant opportunities due to a burgeoning middle class with increasing disposable income and a growing appetite for Westernized consumer goods. Urbanization and changing lifestyles in these regions are fueling demand for a wider variety of processed foods, beverages, and personal care products, all of which rely on sophisticated flavor and fragrance profiles. Conversely, mature markets in North America and Europe continue to be strongholds, driven by sophisticated consumer tastes and a demand for high-value, specialized F&F solutions. However, these regions are also characterized by more intense competition and a greater emphasis on regulatory compliance and product safety.

Economic headwinds, such as inflation and potential supply chain disruptions, present a complex backdrop for the F&F sector in 2024. While the demand for F&F products is generally considered relatively inelastic, particularly for essential goods, the cost of raw materials, energy, and logistics can significantly impact profit margins. Companies are actively seeking strategies to mitigate these challenges, including long-term sourcing agreements, diversification of supplier bases, and investments in more efficient production processes. The ability to pass on increased costs to consumers can also vary depending on product category and brand positioning. Premium products with strong brand loyalty may have more leeway in price adjustments compared to mass-market offerings.

Technological innovation is a pivotal driver of growth and differentiation within the F&F industry. Advancements in biotechnology, such as precision fermentation and synthetic biology, are enabling the creation of novel ingredients and more sustainable production methods for natural compounds. Artificial intelligence (AI) is also playing an increasingly important role in flavor and fragrance design, analyzing vast datasets of consumer preferences and chemical compositions to predict successful scent and taste combinations. This data-driven approach can accelerate the product development cycle and lead to more targeted and successful product launches. Furthermore, advancements in encapsulation technologies are enhancing the stability and longevity of flavors and fragrances, improving product performance and consumer satisfaction.

The food and beverage sector remains the largest end-user of flavors, with a continuous demand for innovative taste profiles that cater to evolving dietary trends. The rise of plant-based foods, for instance, necessitates the development of authentic and appealing flavor solutions to mimic traditional animal-based products. Similarly, the demand for healthier options, such as reduced-sugar or low-calorie products, requires sophisticated flavor masking and enhancement techniques. In the beverage industry, functional drinks and craft beverages are creating opportunities for unique and exotic flavor combinations.

The fragrance segment, while smaller than flavors, is equally dynamic. The personal care market, encompassing perfumes, cosmetics, and toiletries, is a major consumer of fragrances. The increasing trend towards personalized wellness and self-care is translating into a demand for more nuanced and mood-enhancing fragrances. The home fragrance market, including candles, diffusers, and air fresheners, has also seen significant growth, reflecting a desire to create pleasant and inviting living spaces. Sustainability and natural sourcing are particularly prominent in this segment, with consumers seeking perfumes made from ethically sourced essential oils and botanicals.

Mergers and acquisitions (M&A) continue to be a strategic tool for F&F companies looking to expand their market reach, acquire new technologies, or consolidate their positions. These activities can reshape the competitive landscape, leading to greater consolidation among major players and creating opportunities for smaller, innovative companies to be acquired or to form strategic partnerships. The drive for vertical integration, from sourcing raw materials to finished product development, is also a recurring theme in industry consolidation.

Regulatory landscapes play a crucial role in shaping the F&F market. Stringent regulations concerning food safety, chemical usage, and labeling requirements, particularly in regions like the European Union, necessitate significant compliance efforts from F&F companies. Staying abreast of evolving regulations and ensuring product safety and transparency is paramount for market access and consumer trust. The development of new ingredients and formulations often requires extensive testing and approval processes.

Looking ahead, the F&F industry is expected to maintain its growth trajectory, driven by ongoing consumer demand for sensory enrichment and product innovation. The emphasis on naturalness, sustainability, and personalized experiences will continue to shape product development and market strategies. While economic uncertainties may introduce some volatility, the fundamental appeal and essential nature of flavors and fragrances in everyday products provide a strong foundation for continued resilience and expansion in the global marketplace throughout 2024 and beyond. The ability of F&F companies to adapt to these evolving consumer and economic landscapes will be key to their sustained success.