Serbia’s mobile ecosystem in 2024 is characterized by the enduring dominance of two major operating systems, reflecting global trends while also exhibiting unique national characteristics. The market, like many across Eastern Europe and beyond, is overwhelmingly influenced by the strategic positioning and consumer adoption of Google’s Android and Apple’s iOS. Understanding the nuances of their market share, user engagement, and the underlying economic factors driving these preferences is crucial for businesses operating within or seeking to enter the Serbian digital economy.

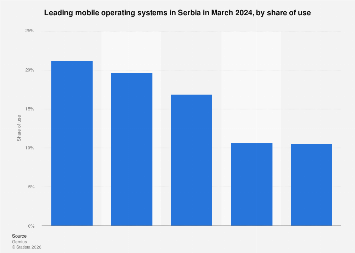

Android continues to hold a commanding position in the Serbian market, a trend that aligns with its global prevalence, particularly in emerging and mid-income economies. This dominance is fueled by a wider range of device price points, catering to a broad spectrum of Serbian consumers. From budget-friendly smartphones to high-end flagship models, the Android ecosystem offers unparalleled choice, a key factor for a market where purchasing power can vary significantly. The open-source nature of Android also allows for greater customization by device manufacturers, leading to a diverse array of hardware features and user interfaces that appeal to different segments of the population. Data from market analysis firms consistently show Android’s share in Serbia hovering around the 70-75% mark, a figure that has remained relatively stable over the past few years, indicating a mature and entrenched user base.

This widespread adoption of Android translates into significant economic implications. A larger Android user base means a more extensive market for Android-specific applications, games, and digital services. Businesses developing mobile applications are likely to prioritize the Android platform for broader reach and potential customer acquisition. Furthermore, the proliferation of Android devices supports a vibrant secondary market for used smartphones and accessories, contributing to the circular economy and providing more affordable access to technology for a larger segment of the Serbian population. The country’s telecommunications sector also benefits, as a greater number of mobile users translate into higher data consumption and service revenue.

Conversely, Apple’s iOS commands a significant, albeit smaller, share of the Serbian mobile operating system market. While iOS devices are typically positioned at a premium price point, they have cultivated a loyal user base in Serbia, often associated with higher disposable incomes and a preference for premium user experience, security, and brand prestige. The ecosystem’s integration across Apple devices – iPhones, iPads, and Macs – also plays a role in user retention, creating a sticky environment for those invested in the Apple universe. In Serbia, iOS typically accounts for between 25-30% of the market share. While this is a substantial segment, it highlights a more niche, yet highly valuable, consumer group.

The economic impact of the iOS segment, though smaller in user numbers, is often disproportionately high in terms of consumer spending. iOS users are generally perceived to be more willing to spend on premium applications, in-app purchases, and subscription services. This makes the Serbian iOS market attractive for developers and businesses targeting a demographic with a higher propensity for digital commerce. The presence of a robust iOS user base also influences the types of mobile payment solutions and e-commerce platforms that gain traction, as these often need to be seamlessly integrated with Apple’s Wallet and App Store payment systems.

Several factors contribute to the ongoing dynamics of these two operating systems in Serbia. The competitive landscape among smartphone manufacturers, particularly for Android devices, intensifies price wars and drives innovation, making new technology more accessible. Government initiatives promoting digital literacy and connectivity also play a role, gradually expanding the overall mobile user base, with Android typically capturing the majority of newly acquired users due to its affordability. The growth of local e-commerce and fintech sectors is also intrinsically linked to mobile operating system penetration. As more Serbians rely on their smartphones for daily transactions and services, the platforms that facilitate these activities become more critical.

Global economic trends also cast a long shadow over the Serbian mobile market. Fluctuations in global supply chains can impact the availability and pricing of both Android and iOS devices. Inflationary pressures can affect consumer purchasing power, potentially leading to a greater reliance on mid-range and budget Android devices. Conversely, periods of economic growth and increased consumer confidence could see a slight uptick in demand for premium devices, potentially benefiting Apple.

Looking ahead, the Serbian mobile operating system landscape is likely to remain dominated by Android and iOS, but with evolving user behaviors and technological advancements. The increasing integration of artificial intelligence in mobile devices, the continued growth of 5G technology, and the rise of the Internet of Things (IoT) will further shape how users interact with their devices and the services they access. For businesses, a nuanced understanding of the Serbian market, differentiating between the spending habits and technological adoption patterns of Android and iOS users, will be paramount for developing effective digital strategies and maximizing market penetration. The continued analysis of this dynamic market will be essential for navigating the evolving digital frontier in Serbia.