The mid-2010s marked a watershed moment for Europe’s financial technology sector, a period characterized by a surge of innovative companies fundamentally altering consumer perceptions of banking. This era witnessed a dramatic shift in capital allocation, with venture funding for fintechs escalating from $19.4 billion in 2015 to $33.3 billion by 2020, according to McKinsey & Company. While the initial feverish growth has somewhat moderated, one entity continues to embody the audacious spirit of its nascent years: Revolut, the app-based financial services provider, and currently, Europe’s most highly valued fintech. Having successfully transitioned from startup to unicorn and now to a profit-generating institution, Revolut reported a more than doubling of its profits to £1 billion in 2024, alongside a significant surge in its customer base to 65 million. This trajectory strongly suggests that CEO and co-founder Nikolay Storonsky’s strategic vision is resonating within the market.

Established in 2015, Revolut began its journey as a prepaid card offering seamless, fee-free currency exchange. Through years of strategic diversification into new service verticals and consistent expansion of its core banking operations, Revolut has evolved into a comprehensive digital financial hub. Its offerings now span cryptocurrency trading, in-app eSIMs for global travelers, and a host of other services. Storonsky himself has articulated an ambition to create the "Amazon of banking," a testament to his desire for Revolut to become a dominant, all-encompassing financial platform. While this "jack of all trades" approach has driven its rapid expansion, Storonsky’s expectation is to achieve mastery across all these domains.

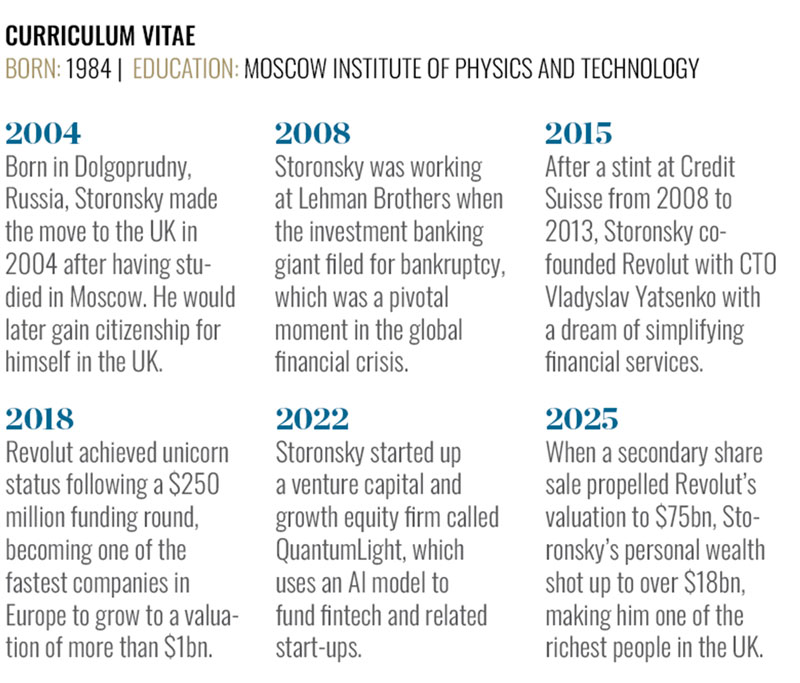

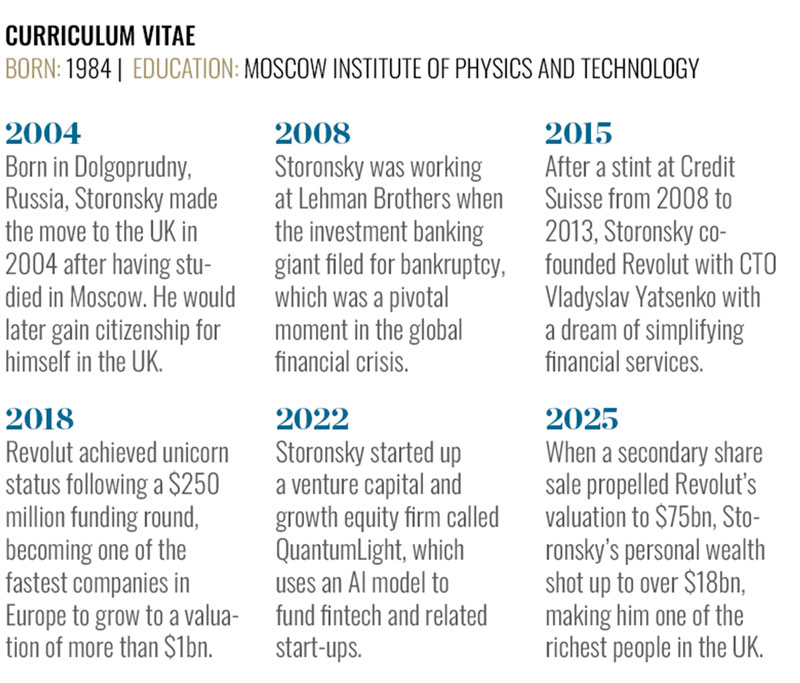

Despite Revolut’s undeniable successes, the path to global banking preeminence is fraught with challenges. Securing banking licenses has proven to be a complex and time-consuming process. Furthermore, in line with many rapidly scaling technology firms, Revolut has faced scrutiny regarding its demanding corporate culture, with former employees reporting intense work environments. Adding to this, a recent secondary share sale propelled the company’s valuation to an impressive $75 billion, a substantial increase from $45 billion the previous year, prompting some analysts to question the company’s current market valuation. Nevertheless, Storonsky remains steadfast in his pursuit of continued innovation and aggressive geographic expansion, posing the critical question of whether he possesses the acumen to forge the world’s leading financial services provider.

The genesis of Revolut is intrinsically linked to the profound impact of the 2008 financial crisis. The collapse of Lehman Brothers sent seismic tremors through the global financial industry, and for Nikolay Storonsky, the repercussions were deeply personal. A native of Russia, Storonsky relocated to the UK in 2004, armed with degrees in physics and applied economics. He soon embarked on a career as a derivatives trader at a major lender. The unexpected bankruptcy of Lehman Brothers, a colossal investment bank, left a lasting impression. As Storonsky recounted to CNBC, "It was a big and powerful investment bank, so the announcement came as a shock. We were told without much warning, and it seemed to happen quite quickly."

This pivotal event, which reportedly cost him approximately half a million pounds, instilled in Storonsky a deep appreciation for data-driven decision-making. Following his tenure at Credit Suisse, where he worked from 2008 to 2013, Storonsky began conceptualizing a revolutionary approach to financial services: a user-friendly app designed to simplify transactions and drastically reduce currency exchange fees. In 2015, he partnered with Vladyslav Yatsenko, a British-Ukrainian software developer with prior experience at UBS and Deutsche Bank, who continues to serve as Revolut’s Chief Technology Officer, to co-found Revolut.

Concurrently, the broader financial technology landscape was experiencing its own transformation. The lingering distrust in established banking institutions, a direct consequence of the global financial crisis, fostered an environment ripe for a new generation of digital-first financial service providers. Companies such as Germany’s N26 and Fidor, Brazil’s Nubank, and the United States’ Chime emerged alongside Revolut, all promising enhanced convenience, superior user experiences, and the agility to adapt services rapidly. Many of these ventures were founded by individuals disillusioned by the fallout of the 2008 crisis, mirroring Storonsky’s own sentiment. "A number of successful entrepreneurs rose from the ashes who were pretty disillusioned with the financial system," he observed.

Revolut’s trajectory post-launch was marked by exceptionally rapid growth. By 2018, a significant $250 million funding round elevated the fintech’s valuation beyond the $1 billion threshold, instantly conferring unicorn status and making it one of Europe’s fastest-growing tech companies to achieve this milestone. Even at this early stage, Storonsky signaled that Revolut’s ambitions were far from fulfilled. "Our focus, since we launched, has been to do everything completely opposite to traditional banks," he stated. "We build world-class tech that puts people back in control of their finances, we speak to our customers like humans and we’re never afraid to challenge old thinking in order to innovate."

Storonsky’s vision extended to dismantling the established banking order, envisioning a future where "Anyone in the world can just download the Revolut app and set up a local bank account to access any services they need," as he articulated to Business Insider in 2017. This forward-looking approach is epitomized by Revolut’s "new bets" division, a dedicated unit focused on incubating and launching novel revenue streams.

The ethos of "move fast and break things," popularized by Mark Zuckerberg, is deeply embedded in Revolut’s operational DNA. The company has demonstrated a remarkable ability to swiftly introduce new services, ranging from mobile phone plans to loyalty point programs. These ventures have proven to be potent revenue generators, with cryptocurrency trading serving as a prime example. The "new bets" division played a pivotal role in propelling Revolut to its first annual profit in 2021, capitalizing on the burgeoning interest in digital assets among retail investors. Ed Gibbins, co-founder and CEO of ChaseLabs, a sales development system, commented on Storonsky’s leadership, stating, "Nikolay Storonsky’s leadership of Revolut highlights how speed and adaptability can really define success in fintech. His approach reflects a deep understanding of tech disruption: launch quickly, scale globally, and then refine using real user feedback. This ability to treat global markets as testing grounds means Revolut can adapt features faster than rivals and align its offerings closely with consumer demand."

Each "new bet" at Revolut typically originates with a lean team of approximately ten individuals, often spearheaded by an entrepreneurially experienced employee, as reported by Sifted. With a seed budget of around £2 million to £3 million, these teams are tasked with developing experimental products within tight timelines, often as short as 18 months, with many launching even more rapidly. This agile methodology allows Revolut to maintain a competitive edge over traditional banks and even many fintech challengers. Gibbins further elaborated, "The strategy of rapid feature deployment and constant iteration allows the company to test ideas across markets and double down on what works. This cycle of innovation and responsiveness has enabled Revolut to outpace competitors and strengthen its position as a leading player in global fintech."

Successful "new bets" are scaled aggressively, while those that underperform are either refined, scaled back, or discontinued. According to a Revolut spokesperson, 45 "new bets" have been approved to date, with some still in development, operating under a model inspired by venture capital principles. Storonsky himself is no stranger to the VC world, having launched his own firm, QuantumLight, in 2022, which employs an AI model to identify and invest in fintech and related startups.

Revolut’s appeal to its customer base lies in its blend of agility and comprehensive service offering. Michael Foote, founder of insurance comparison tool Quote Goat, noted, "Revolut’s rise has been driven by a clear focus on tech-savvy consumers who expect more than traditional banking can deliver. By combining everyday money management with trading and payments inside one app, the company positions itself as a lifestyle tool rather than a conventional bank. This multifunctional approach has given it strong appeal among younger customers who value speed, convenience, and variety without juggling multiple providers." As of September 2025, Revolut reported surpassing 65 million customers globally, with Storonsky, who is estimated to hold a 25 percent stake in the company, boasting a net worth of $7.9 billion according to Forbes.

While Revolut celebrates escalating customer numbers and robust profits, the company’s financial success has been accompanied by significant operational challenges that have impacted its reputation. The firm’s aggressive corporate culture has faced considerable scrutiny, with allegations from former employees citing unachievable targets, unpaid overtime, and immense pressure. This demanding work environment was, for many years, an open secret. Storonsky, in a 2017 interview with Business Insider, stated, "We are not about long hours – we are about getting shit done. If people have this mentality, they work long hours because they want it."

Analysis of thousands of reviews on platforms like Glassdoor, as of October 2025, reveals a consistent theme of poor work-life balance and a prioritization of targets above all else. Despite these criticisms, many reviewers acknowledge that while the high-pressure environment is not suited to everyone, some individuals thrive within it. Storonsky elaborated on this, telling Business Insider that employees were "really motivated, really sharing the vision of where we want to go and as a result, they work long hours – they work at least 12 or 13 hours a day. All the key people, all the core team. A lot of people also work on weekends."

In subsequent interviews, Storonsky has indicated that changes have been implemented, stating in a 2019 Reuters interview, "We are a different company than we were two to three years ago. We have learned lessons." However, reports from 2023 indicated that the company established an internal team to monitor employee conduct regarding inclusivity, approachability, and respect, aiming to foster a more "human" workplace. Francesca Cassidy, editor at Raconteur, a business news website, questioned the efficacy of such initiatives in isolation. She wrote, "Storonsky wants Revolut to be the ‘Amazon of banking.’ In pursuing this objective, he works tirelessly and expects much the same from his colleagues. With such a dedicated, driven character at the helm, it is little wonder that Revolut’s culture has developed as it has." Cassidy further argued that efforts to improve performance reviews and introduce reward programs "do little to address the high-performance culture that seems to be the source of much of the negative feedback. How can employees be expected to pour their energy into being pleasant, collaborative colleagues if they are overworked, under stress and burnt out?"

Beyond internal culture, Revolut has navigated a protracted and complex process in obtaining its full UK banking license. While it secured an EU banking license via Lithuania in 2018, its application for a UK license, following a three-year review, was still pending approval at the time of this report. The Bank of England had reportedly expressed concerns regarding Revolut’s capacity to maintain robust risk management controls in light of its rapid international expansion, according to the Financial Times. Storonsky has acknowledged that prioritizing rapid growth over the immediate pursuit of a full UK banking license was a strategic miscalculation. Obtaining this license would unlock the ability to offer a broader spectrum of financial products, including lending services such as mortgages and savings accounts, enabling direct competition with incumbent banks in the UK market. Furthermore, a UK license could serve as a catalyst for securing licenses in other key markets like the United States, Australia, and Japan, and potentially pave the way for a public stock offering, likely in London or New York.

While Storonsky’s global ambitions for Revolut are vast, his entrepreneurial pursuits extend beyond the digital bank. QuantumLight, his venture capital firm, recently announced the successful closure of its inaugural $250 million fund. The firm is dedicated to supporting promising founders across artificial intelligence, web3, fintech, software as a service (SaaS), and healthtech. QuantumLight embodies Storonsky’s data-centric philosophy, aiming to inject "scientific precision into venture capital." In a statement, Storonsky declared, "Our ambition is to build the world’s best systematic venture capital and growth equity firm." QuantumLight also functions as a strategic promotional tool for Revolut, disseminating public "playbooks" that showcase Revolut’s expertise and offer guidance to founders seeking to replicate its success. Its latest publication, "Hiring Top Talent," co-authored by Storonsky, details the operational principles Revolut employed to "systematically scale world-class teams," presenting a blueprint for its recruitment engine that enabled the company to grow to over 10,000 employees in a decade. Ilya Kondrashov, CEO of QuantumLight, stated, "Our goal is to make the invisible operating systems behind iconic companies like Revolut visible and replicable. Founders shouldn’t have to reinvent the wheel when it comes to building high-performing teams. By sharing these tools and frameworks, we’re helping scale-ups move faster from day one."

In addition to his venture capital endeavors, Storonsky has also ventured into the luxury market with Utopia Design, a high-end travel company discreetly established in 2023, according to Forbes. This venture, inspired by his personal passion for kite surfing, encompasses exclusive luxury villas in destinations like the Dominican Republic, Brazil, and Barcelona. While these ventures may offer personal enrichment and financial returns, Revolut remains his primary revenue stream. Reports suggest a multibillion-dollar payout is contingent on Revolut’s valuation reaching $150 billion, a structure similar to that approved for Elon Musk at Tesla, which would grant Storonsky additional staged equity stakes.

Revolut’s future trajectory hinges significantly on its ability to continue acquiring and retaining customers. As Storonsky stated in a 2019 interview with CNBC, "The whole idea was we provide the product for free, then we cross-sell other services. So we just need to have large customer numbers." This strategy underpins his ambitious target of reaching 100 million retail customers globally by mid-2027 and expanding into over 30 new markets by 2030, with the ultimate aim of becoming "the world’s leading financial services provider."

"Our mission has always been to simplify money for our customers, and our vision to become the world’s first truly global bank is the ultimate expression of that," Storonsky remarked. In pursuit of this vision, Revolut has allocated $500 million to accelerate its U.S. operations, with its U.S. CEO confirming investigations into either applying for a banking license or acquiring an existing U.S. bank to expedite market entry. The company plans to invest $13 billion over the next five years in its global expansion. Upcoming launches include Mexico in early 2026 and India in the near future. A new global tech hub in the Philippines is set to support operations in Australia and New Zealand, where Revolut is actively pursuing banking licenses. The company is also initiating its expansion into Africa, with South Africa as a primary target, and has secured an in-principle license in the UAE for Middle Eastern market entry. Rumors even suggest a potential move into China.

Revolut’s "new bets" unit is expected to continue developing innovative financial products, though specific areas remain undisclosed. Announcements from September 2025 indicate a focus on AI and private banking. However, the successful execution of Storonsky’s international expansion plans may necessitate tailoring these new verticals to specific regional regulatory requirements, presenting both opportunities for bespoke offerings and potential challenges due to increased red tape.

"Nikolay Storonsky’s strategy has centered on rapid global expansion and aggressive feature rollout," observed Foote. "The combination of constant innovation and international reach has set the business apart, showing how fintechs can compete with traditional banks by being faster to market and more responsive to customer demand." Despite Revolut’s relentless pursuit of growth and its achievement of profitability, concerns persist in some quarters regarding its $75 billion valuation. However, if Storonsky can successfully implement his ambitious global expansion agenda and consistently deliver compelling new products, he is well-positioned to silence these critics and solidify Revolut’s position as a dominant force in global finance.