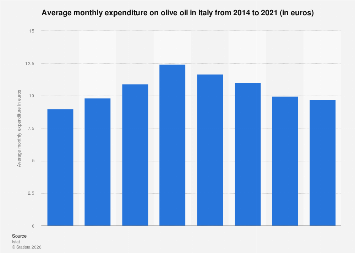

Italian households saw a notable fluctuation in their average monthly expenditure on olive oil between 2014 and 2021, a period marked by evolving agricultural conditions, global supply chain pressures, and changing consumer preferences. While the data indicates an initial upward trend in spending during the mid-2010s, the latter half of the period witnessed a recalibration, suggesting a complex interplay of economic and market factors influencing household budgets for this staple commodity.

From 2014, the average monthly outlay for olive oil by Italian families began a steady ascent. This period likely reflected a combination of factors. Firstly, robust domestic and international demand for high-quality Italian olive oil could have driven up prices. Italy, renowned for its diverse and prized olive oil varieties, often commands premium pricing in global markets. Secondly, agricultural challenges such as adverse weather events, pests like the olive fruit fly, and diseases impacting olive groves could have led to reduced yields, consequently tightening supply and pushing up costs. These production constraints often translate directly to higher retail prices.

The trend continued to climb through 2017. During these years, the average monthly expenditure represented a consistent, albeit gradual, increase. This suggests that consumers were either willing to absorb these rising costs or that the perceived value of olive oil – its culinary significance, health benefits, and cultural importance in Italian households – remained a priority. For many Italian families, olive oil is not merely a cooking ingredient but a fundamental element of their diet and culinary heritage, making it a less elastic good in terms of demand.

However, the landscape began to shift by 2021. The data points to a discernible decrease in the average monthly expenditure on olive oil. This downturn warrants a deeper examination of the forces at play. Several potential drivers could explain this contraction in household spending. One significant factor could be increased price volatility in the global olive oil market. While certain periods might see price spikes due to supply issues, broader market dynamics, including increased production in other Mediterranean countries or shifts in global trade policies, could lead to price stabilization or even reductions.

Furthermore, the economic climate of the period leading up to 2021, potentially exacerbated by the initial impacts of the COVID-19 pandemic, may have led households to re-evaluate discretionary spending. While olive oil is a staple, families might have sought to optimize their grocery budgets by opting for less expensive olive oil varieties, reducing overall consumption, or exploring alternative cooking oils if price differentials became significant. The pandemic, in particular, disrupted global supply chains, affecting everything from agricultural inputs to shipping costs, which in turn could have influenced both production costs and consumer purchasing power.

Another consideration is the evolving retail landscape. The rise of discount retailers and the increased availability of private-label olive oil brands could have provided consumers with more budget-friendly options. These brands often compete on price, offering alternatives to more established and premium producers. The survey, which sampled approximately 28,000 households, provides a broad snapshot of typical spending patterns, and changes in the availability and affordability of different product tiers would certainly influence the aggregate average.

Global comparisons offer further context. While Italy is a major producer and consumer, other olive oil-producing nations like Spain and Greece also experience similar market dynamics. Fluctuations in their production levels and export prices can impact the global olive oil market, influencing the cost of imported oils in countries like Italy, as well as the domestic price competitiveness. For instance, if Spain experiences a bumper crop, its increased supply can exert downward pressure on global prices, potentially benefiting Italian consumers.

The economic impact of these spending patterns extends beyond individual households. For the Italian olive oil industry, which is a significant contributor to the country’s agricultural output and export revenues, shifts in domestic consumption are crucial. A sustained decrease in household spending could signal challenges for domestic producers, particularly those focused on the premium segment, if it indicates a broader move towards lower-priced alternatives or reduced overall consumption. Conversely, it could also spur innovation in cost-effective production or marketing strategies.

The period from 2014 to 2021 represents a dynamic phase for Italian olive oil consumption. The initial rise in expenditure likely reflected a combination of rising production costs and sustained consumer demand for a culturally significant product. The subsequent decline suggests a recalibration driven by a complex mix of potential price stabilization, economic pressures on households, and evolving retail offerings. Understanding these trends is vital for policymakers, industry stakeholders, and consumers alike as they navigate the ongoing evolution of the olive oil market, both within Italy and on the international stage. The data from this survey period provides a valuable lens through which to view the resilience and adaptability of Italian households in managing their spending on this essential culinary cornerstone.