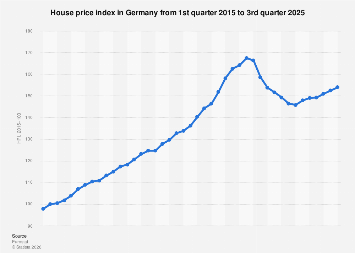

The German residential property market, a cornerstone of the nation’s economy, has experienced a significant shift, moving from a prolonged period of robust price appreciation to a phase of correction. Data tracking the House Price Index (HPI) from the first quarter of 2015 through projections for the third quarter of 2025 reveals a dynamic trajectory that offers crucial insights for investors, policymakers, and consumers alike.

For much of the period between 2015 and 2022, the HPI in Germany exhibited a consistent upward trend. The index, which began with a base of 100 in 2015, reached its zenith in the second quarter of 2022, surpassing 167 index points. This marked a substantial increase of approximately 67 percent in residential property values over a roughly seven-year span. This period was characterized by low interest rates, a strong economy, and a persistent demand for housing, particularly in desirable urban centers. Cities like Munich, for instance, consistently reported the highest per-square-meter prices for apartments, reflecting the premium placed on prime locations.

However, the latter half of 2022 and the subsequent period into early 2024 witnessed a palpable deceleration and subsequent decline in the HPI. This recalibration is attributed to a confluence of macroeconomic factors. The aggressive monetary policy tightening by the European Central Bank (ECB) to combat soaring inflation led to a sharp rise in borrowing costs. Higher mortgage rates significantly impacted affordability for prospective buyers, dampening demand. Furthermore, persistent inflation, while easing from its peak, continued to exert pressure on household budgets, reducing discretionary spending and investment capacity in real estate. Geopolitical uncertainties, including the ongoing conflict in Ukraine and its ripple effects on energy prices and supply chains, also contributed to a more cautious investment climate.

The provisional data for 2024 and the projections for 2025 paint a picture of a market in a state of adjustment rather than outright collapse. Following a low of 145.8 in the first quarter of 2024, the HPI has shown tentative signs of stabilization, projected to reach 149.2 by the fourth quarter of 2024. Looking ahead to 2025, the index is forecast to climb further, reaching 150.9 in the first quarter, 152.4 in the second, and 153.9 in the third quarter. While these projected figures indicate a recovery in price growth, they remain below the peak levels seen in mid-2022. This suggests a market that is gradually regaining momentum but operating within a new, higher-interest-rate environment.

The implications of this market correction are multifaceted. For homeowners, the period of rapid asset appreciation has paused, and in some instances, values have seen a moderate decline from their peaks. This can affect homeowners’ equity and their capacity to leverage their properties for other investments or financial needs. For potential buyers, the increased cost of borrowing has created a significant barrier, although the projected stabilization and modest growth in prices might present opportunities for those who can secure financing.

From an economic perspective, the German real estate market plays a vital role in broader economic activity. A robust property market supports construction, related industries such as furniture and home improvement, and contributes to household wealth, which can influence consumer spending. A sustained downturn could have negative spillover effects, but the current data suggests a more measured correction. The stabilization and projected modest growth indicate that the market is adapting to new economic realities.

Comparing Germany’s experience with other major European real estate markets provides valuable context. Many countries across the Eurozone have also experienced a cooling of their housing markets following similar interest rate hikes and inflationary pressures. However, the extent and duration of these corrections vary depending on local supply-demand dynamics, economic resilience, and government housing policies. Germany’s relatively strong economic fundamentals, despite current challenges, might contribute to a more resilient recovery compared to some other European nations.

The long-term outlook for the German property market will likely depend on several key factors. The trajectory of inflation and the ECB’s monetary policy will be paramount. If inflation is brought under control more sustainably, interest rates may stabilize or even begin to decline in the medium to long term, which would provide a significant boost to housing demand. Secondly, the supply of new housing remains a critical issue. Germany has historically faced a deficit in housing construction, particularly in high-demand urban areas. Government policies aimed at accelerating construction, streamlining planning processes, and encouraging investment in new housing stock will be crucial for meeting future demand and ensuring affordability.

Furthermore, demographic trends, including an aging population and continued immigration, will continue to shape housing demand. The need for accessible and affordable housing for all age groups and income levels will remain a persistent challenge. The market’s ability to adapt to these demographic shifts, potentially through increased development of senior living facilities and more diverse housing options, will be a key indicator of its long-term health.

In conclusion, Germany’s residential property market is navigating a period of adjustment, moving away from the exceptional price growth of the past decade. While the peak of the boom has passed, the market is showing signs of stabilization and projected modest growth. This recalibration is a natural response to evolving macroeconomic conditions. The coming years will be critical in determining the pace and nature of the market’s recovery, influenced by monetary policy, housing supply initiatives, and broader economic developments. The data suggests a market that is resilient and adapting, rather than entering a protracted downturn, but vigilance and strategic responses from policymakers and market participants will be essential for fostering sustainable growth and affordability.