The burgeoning landscape of Decentralized Finance (DeFi) is on an irreversible trajectory towards significant expansion, with projections indicating a substantial surge in Total Value Locked (TVL) across its foundational blockchain networks by the year 2025. This growth, fueled by increasing institutional adoption, technological advancements, and a growing user base seeking transparent and accessible financial services, signals a transformative shift in the global financial architecture. While the exact figures for future TVL are subject to market dynamics and regulatory developments, the underlying trend points towards a multi-trillion-dollar valuation for the DeFi sector within the next few years.

The DeFi ecosystem, which offers alternatives to traditional financial intermediaries like banks and exchanges, relies on smart contracts deployed on various blockchain networks. These networks act as the infrastructure upon which decentralized applications (dApps) are built, facilitating services such as lending, borrowing, trading, and asset management without central authority. The TVL, a key metric in the DeFi space, represents the total amount of cryptocurrency assets deposited into smart contracts across these platforms. A rising TVL signifies increased confidence and participation in the DeFi market.

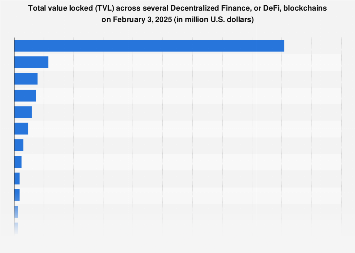

Ethereum, the pioneer and undisputed leader in the smart contract space, has historically dominated the DeFi TVL. Its robust developer community, extensive range of dApps, and established network effects have cemented its position. However, the scalability challenges and associated transaction fees on Ethereum have created fertile ground for competing blockchains to emerge and capture market share. These "Ethereum killers" or Layer 1 alternatives, such as Solana, Binance Smart Chain (now BNB Chain), Polygon, Avalanche, and Cardano, have made significant strides in offering lower transaction costs, faster processing times, and improved user experiences.

Solana, for instance, has attracted substantial developer talent and capital due to its high throughput and low latency, enabling a vibrant ecosystem of DeFi protocols, including decentralized exchanges (DEXs) and lending platforms. BNB Chain, leveraging the vast user base of the Binance exchange, has also witnessed rapid growth in its DeFi offerings, attracting both retail and institutional participants. Polygon, a Layer 2 scaling solution for Ethereum, has effectively addressed Ethereum’s scalability issues by providing a framework for building and connecting blockchain networks, thereby facilitating a more cost-effective and efficient DeFi experience. Avalanche, with its unique consensus mechanism and subnet architecture, offers a highly scalable and customizable platform for DeFi applications. Cardano, with its research-driven approach and focus on security and sustainability, is also steadily building its presence in the DeFi arena.

The projected growth in DeFi TVL by 2025 is not merely an extrapolation of current trends; it is underpinned by several powerful economic drivers. Firstly, the increasing sophistication of DeFi products and services is making them more attractive to a broader audience. Yield farming, liquidity mining, and sophisticated derivatives are offering novel ways for investors to generate returns, often surpassing those available in traditional finance. Secondly, regulatory clarity, while still evolving, is gradually improving in key jurisdictions. As regulators establish frameworks for digital assets and DeFi, institutional investors, who have historically been hesitant due to compliance concerns, are beginning to allocate capital to the sector. Reports from major financial institutions and consulting firms consistently highlight the growing interest in blockchain technology and digital assets from traditional financial players, indicating a significant potential inflow of capital into DeFi.

Furthermore, the global economic environment plays a crucial role. In periods of low-interest rates and inflationary pressures, investors are actively seeking alternative investment avenues. DeFi protocols, with their potential for higher yields and diversification, offer an appealing proposition. The accessibility of DeFi, requiring only an internet connection and a cryptocurrency wallet, also democratizes financial services, particularly for unbanked and underbanked populations worldwide. This inclusive aspect of DeFi presents a significant long-term growth opportunity, expanding the total addressable market beyond traditional financial systems.

Market data from various analytics firms paints a compelling picture of this evolving landscape. While specific 2025 projections are proprietary and often require subscription access, broader industry analyses consistently point towards exponential growth. For example, the total DeFi TVL, which experienced a dramatic surge in 2021 and has since undergone periods of volatility influenced by broader cryptocurrency market sentiment, has shown resilience and a steady upward trend in recovery. Leading analytics platforms report that the TVL has consistently surpassed previous highs, indicating sustained investor confidence. By 2025, it is not unreasonable to expect the aggregate TVL across all major blockchains to reach figures well into the trillions of U.S. dollars, a substantial leap from the hundreds of billions currently being tracked.

The economic impact of this growth is multifaceted. On a macro level, the expansion of DeFi has the potential to foster greater financial inclusion, reduce transaction costs, and increase the efficiency of capital allocation globally. It can also lead to the creation of new financial products and services, driving innovation and economic activity. On a micro level, it offers individuals and businesses new avenues for wealth creation, capital raising, and risk management. The development of DeFi infrastructure also stimulates job creation in areas such as blockchain development, smart contract auditing, cybersecurity, and community management.

However, the path to widespread DeFi adoption is not without its challenges. Security remains a paramount concern, with smart contract vulnerabilities and exploits posing significant risks to user funds. The DeFi space has experienced numerous high-profile hacks, resulting in substantial financial losses. Consequently, rigorous auditing, bug bounty programs, and robust security practices are becoming increasingly critical for dApp developers. Regulatory uncertainty, as mentioned earlier, continues to be a hurdle. The decentralized nature of DeFi makes it difficult to apply traditional regulatory frameworks, and the ongoing debate about how to govern these protocols will shape their future development and adoption. Interoperability between different blockchains is another area requiring continued innovation. As more blockchains enter the DeFi space, seamless asset and data transfer between them will be essential for a truly interconnected ecosystem.

Despite these challenges, the fundamental drivers of DeFi growth remain strong. The inherent advantages of transparency, immutability, and programmability offered by blockchain technology are difficult to ignore. As the technology matures and the ecosystem becomes more robust, the limitations that currently exist are likely to be addressed. The competition among blockchain networks to attract and retain users and developers will continue to drive innovation and improvements in performance, cost-effectiveness, and user experience.

In conclusion, the trajectory of Decentralized Finance towards 2025 is one of significant expansion and maturation. While Ethereum will likely remain a dominant force, the diversification of the DeFi ecosystem across multiple high-performing blockchains is a key trend. The increasing inflow of institutional capital, coupled with ongoing technological advancements and the inherent benefits of decentralized financial systems, suggests a future where DeFi plays an increasingly integral role in the global financial landscape, unlocking new opportunities and reshaping how we interact with money. The total value locked within these burgeoning ecosystems is set to become a critical indicator of this ongoing financial revolution.