On election night in November 2024, the United States cryptocurrency industry experienced a rare surge of optimism. Investors celebrated what they perceived as the dawn of a new era, with the arrival of a crypto-friendly administration poised to reshape the digital finance landscape. Bitcoin’s value soared to a record high exceeding $75,000, and crypto-linked equities saw significant rallies. Donald Trump, who had campaigned on a platform advocating for American leadership in digital assets, was seen as a champion of this burgeoning sector. His declaration, "If crypto is going to define the future, I want it to be mined, minted and made in the USA," resonated deeply within the industry.

Just a few months into his second term, President Trump moved to fulfill that promise. In July, he signed into law the "Guiding and Establishing National Innovation for US Stablecoins Act," colloquially known as the GENIUS Act. This landmark legislation introduced the first comprehensive federal regulatory framework for stablecoins – digital tokens pegged to the US dollar that form the backbone of the cryptocurrency economy. The passage of the GENIUS Act marked a pivotal moment for digital money, heralding both significant opportunities and inherent risks.

Private Issuance, Public Scrutiny

The GENIUS Act establishes stringent requirements for entities issuing dollar-backed digital tokens. Issuers must maintain verifiable reserves held entirely in cash or short-term government bonds (Treasurys), undergo monthly attestations of these holdings, ensure clear redemption obligations for token holders, and adhere to anti-money laundering (AML) and consumer protection regulations. Critically, the Act categorizes stablecoins as payment instruments rather than securities, thereby resolving years of regulatory ambiguity and mitigating litigation risks for issuers. Mike Hudack, co-founder of Sling Money, a crypto-enabled money transfer application that utilizes stablecoins, observes, "We are witnessing a shift of stablecoins from simply being ‘crypto’ or ‘digital currency’ to being core payments infrastructure."

Beneath the industry’s jubilation lies a calculated strategic decision. While embracing innovation, the administration has simultaneously opted for a private-sector-led model of digital currency over a central bank digital currency (CBDC). One of President Trump’s early actions in his second term was to formally prohibit US authorities from issuing a digital dollar. By rejecting a government-controlled digital dollar, a project often associated with the previous administration, Washington effectively delegated the future of digital money to the private sector. This decision reflects a potent blend of ideological conviction, pragmatic market considerations, and astute political maneuvering. White House officials articulated that a government-issued digital dollar could have placed federal authorities too close to citizens’ financial lives, raising concerns about potential financial surveillance. In contrast, stablecoins offer a market-driven approach to digital payments, while simultaneously reinforcing the global dominance of the US dollar and preserving American financial hegemony in an increasingly digitized world. Currently, approximately 99% of all stablecoins are denominated in US dollars, meaning every transaction conducted with these tokens contributes to the greenback’s extensive global reach.

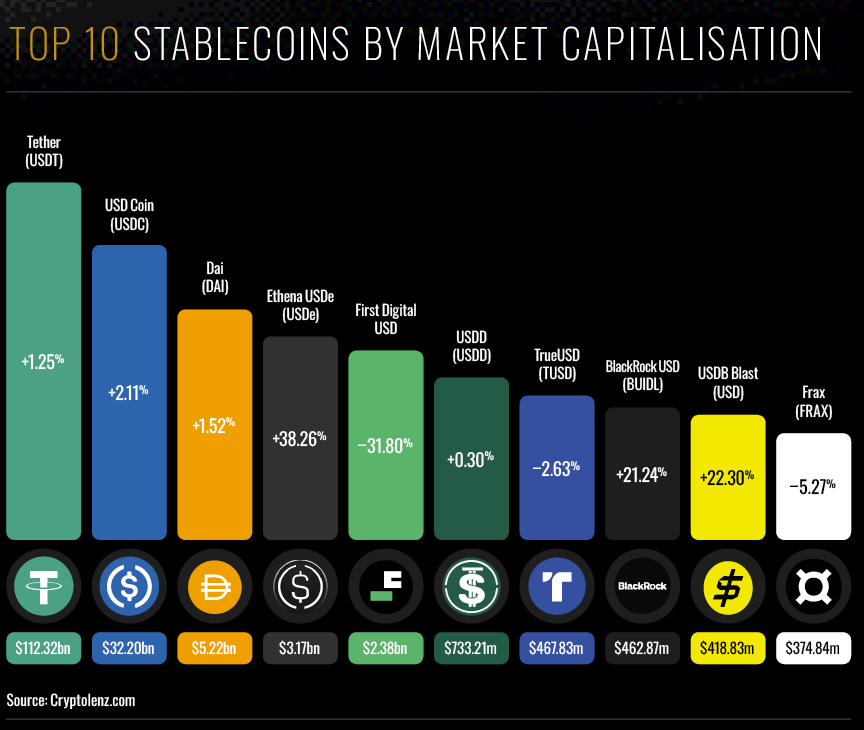

This policy choice also underscores the administration’s ideological resistance to expanding federal control over monetary systems – a stance that resonated with both libertarian voters and the business community during the election cycle. "A CBDC would concentrate financial power within the government, something this administration was never likely to endorse," states Maghnus Mareneck, co-CEO of Cosmos Labs, a US blockchain firm developing an interoperability protocol utilized by financial institutions. "The administration recognizes that stablecoins can modernize the dollar without replacing it." The legislation was met with considerable enthusiasm from crypto firms, which had long grappled with regulatory uncertainty. Many in the industry felt that the Securities and Exchange Commission (SEC), under the leadership of Chairman Gary Gensler, had stifled innovation through aggressive regulatory actions. During his campaign, Trump had pledged to replace Gensler, who had been a key figure in shaping crypto regulation. Gensler’s subsequent resignation in January, well before his term was set to end in 2026, signaled a potential shift in the SEC’s regulatory approach. In the months following the GENIUS Act’s enactment, the stablecoin market experienced a dramatic expansion. Once a niche segment, total stablecoin market capitalization surpassed $300 billion by October, growing at twice the pace of the broader crypto sector. Analysts at Citi project this market to reach $4 trillion by 2030. Tether, the leading issuer of dollar-based stablecoins, is reportedly seeking up to $20 billion in new capital, a move that would elevate its valuation close to the $500 billion mark.

However, critics have voiced concerns about the Act’s perceived leniency regarding the inherent risks associated with stablecoins. Professor Kenneth Rogoff, an international economics expert at Harvard University and former Chief Economist of the IMF, warns, "What the Act does is vastly expand the network effects that make it easier to launder money and operate in the underground economy. It is important for the government to be able to monitor and audit transactions, and the bill is very light on that." David Hoppe, founder of Gamma Law, a US law firm specializing in digital asset cases, adds, "It does not guarantee timely redemption or provide federal insurance, and it lacks clear rules for dispute resolution, unauthorized transfers, or fraud recovery. Oversight is fragmented across state and federal channels, creating space for inconsistent enforcement and charter shopping."

Banks on Guard: Opportunity and Existential Threat

For the traditional banking sector, the ascendance of state-sanctioned stablecoins presents a dual challenge: significant opportunity intertwined with an existential risk, primarily through disintermediation. While few stablecoins currently offer interest, the prospect of issuers beginning to provide yield and businesses adopting them for payroll, trade, and settlements could lead to substantial deposit outflows from commercial banks. This scenario would undermine their traditional model of deposit-funded lending and threaten credit creation capabilities. The balance sheets of financial institutions, already under pressure from the proliferation of digital payment platforms, could shrink further. A recent US Treasury report estimates that up to $6.6 trillion in deposits could leave bank coffers if crypto exchanges are permitted to offer interest payments or similar financial incentives, a development US banks are actively lobbying policymakers to prevent.

Legacy lenders are adopting a cautious strategy, recognizing that they still possess distinct advantages. Lucrezia Reichlin, an economist at the London Business School, notes, "If banks issue their own stablecoins directly, they would be safer, because they have direct access to central bank reserves." Major financial institutions like JPMorgan Chase and Citi are reportedly exploring the issuance of their own dollar-pegged payment tokens. In Europe, nine financial institutions, including UniCredit and ING, are developing euro-denominated stablecoins. Susana Esteban, Managing Director of the Blockchain and Digital Assets practice at FTI Consulting, a US business consultancy firm, suggests, "Banks may look to position themselves as the infrastructure and control layer for stablecoin custody, settlement, and on-chain treasury, providing KYC, segregation, and policy controls, so they can capture fee revenue as liquidity and payments migrate on-chain." She further posits that their ultimate objective might be to offer tokenized deposits, delivering the same "24/7, programmable experience" that stablecoins promise.

The stakes extend beyond mere operational efficiency to encompass national sovereignty. The increasing prominence of privately issued dollar-based digital currencies could diminish the influence of most central banks, fundamentally reshaping the architecture of international finance. Jonathan Church of TransferMate, a fintech payments infrastructure firm, explains, "Stablecoins do not create base currency, so they don’t directly erode the Federal Reserve’s ability to set short-term rates or influence market liquidity." Nevertheless, central bankers express apprehension that a widespread migration to stablecoins could weaken their control over money creation and the transmission of interest rate policies, forcing monetary policy to operate through less predictable channels. As more financial activity moves outside the regulated banking system, the impact of interest rate adjustments might be delayed in filtering through the economy. Andrew Bailey, the Governor of the Bank of England, has recently cautioned that stablecoins could "separate money from credit provision," as non-bank entities assume a more significant role in financial intermediation.

The international payments group SWIFT is also actively adapting to this evolving landscape. It is collaborating with major financial institutions, including Bank of America, Citi, and NatWest, to develop a shared blockchain ledger designed to facilitate transactions, particularly the settlement of tokenized assets like stablecoins. The emergence of stablecoins poses a direct threat to SWIFT’s traditional role by enabling instantaneous transfers that bypass traditional intermediaries. Transactions that once required several days and multiple compliance checks can now be executed in seconds, disrupting decades of established financial infrastructure. SWIFT’s efforts to remain relevant serve as a microcosm for the broader financial system’s challenge: in an era of programmable, borderless money, legacy institutions must innovate or risk becoming obsolete.

The "Trump Effect" and Blurred Lines

A recurring theme throughout the Trump presidency has been the subtle, and at times overt, blurring of lines between public policy and private interests. Members of the President’s family have launched ventures in the cryptocurrency space, including World Liberty Financial, the issuer of the USD1 stablecoin, and American Bitcoin, a mining company co-founded by Donald Trump Jr. and Eric Trump. A popular meme-token, $TRUMP, bears the President’s name. While this intertwining of political influence and commercial gain is not unprecedented for this administration, the stakes are considerably higher in the context of stablecoins, which directly impact the foundational elements of the global financial system, unlike real estate or entertainment ventures.

For proponents, the symbolism is profound: the self-proclaimed dealmaker, renowned for building skyscrapers, now aims to anchor American influence in the realm of digital currency. Critics, however, contend that this alignment of public policy objectives with private profit risks eroding confidence in the neutrality and integrity of US financial regulation. Lawmakers and ethics watchdogs have called for enhanced safeguards, including restrictions on digital asset ownership by politicians and senior government officials, and more robust blind-trust requirements for any holdings. "The president directs agencies responsible for implementing the Act, while his family benefits from a company whose success depends on those same regulations," observes Gamma Law’s Hoppe. "Even if lawful, such circumstances create the perception that private gain could influence public policy, which risks undermining confidence in fair enforcement and market integrity."

Despite these concerns, the administration appears resolute. The underlying calculus in Washington suggests that the future of global digital finance must be denominated in US dollars, even if those dollars are issued by private entities. In this light, the GENIUS Act can be interpreted as a significant geopolitical statement. Both administration officials and members of the Trump family frame the policy as a direct response to de-dollarization efforts spearheaded by China. Donald Trump Jr. stated at a crypto conference in Singapore, "Crypto is actually going to be the thing that preserves dollar hegemony around the world. As stablecoins start becoming the markets and treasuries, that’s going to replace China and Japan and some of these places that say, ‘You know what? We don’t want America to have that power anymore.’"

China’s Digital Yuan Gamble and Europe’s Cautious Approach

China is actively pursuing strategies to diminish the dollar’s global influence, notably through the expansion of its own CBDC, the digital yuan. This initiative has gained momentum following sanctions imposed on Russian banks accused of facilitating the procurement of weapons parts. Beijing has also promoted its Cross-Border Interbank Payment System (CIPS) for international transactions, and lending in renminbi overseas has surged, with outbound renminbi loans, deposits, and bond investments by Chinese banks quadrupling since 2020. Furthermore, China is a key proponent of the m-CBDC Bridge, a multi-CBDC platform designed to facilitate cross-border payments, overseen by the central banks of China, Hong Kong, Thailand, Saudi Arabia, and the UAE.

Lucrezia Reichlin, the London Business School economist, posits, "China’s ambition is not to replace the dollar or make the yuan an alternative to it. They know that it would be unrealistic. But they want to defend the payment system in their financial ecosystem and one way to do it is to control the rails for cross-border payments via digital solutions."

China’s approach to stablecoins is markedly more circumspect. Last summer, the Hong Kong Monetary Authority began accepting applications from stablecoin issuers, a move widely interpreted as Beijing’s response to the US GENIUS Act. Chinese officials suggested that the promotion of stablecoins by the US warranted a response in the form of a renminbi-pegged stablecoin to bolster the yuan’s international usage. However, subsequent statements from various Chinese regulators, including the central bank, have cast doubt on the viability of yuan-based stablecoins, citing concerns that private stablecoins could undermine the government’s own CBDC initiative. This regulatory tightening has prompted major Chinese tech firms like Ant Group and JD.com, which were expected to participate in Hong Kong’s pilot program, to postpone their stablecoin issuance plans. "Beijing wants every digital yuan transaction, whether it is domestic or international, to move through systems it can oversee. Stablecoins inherently create alternative payment networks that the state cannot easily legislate, and that introduces risk and potential fragmentation of issuance for this government," explains Mareneck of Cosmos Labs, an expert on Asian stablecoin markets.

The US push for stablecoin supremacy has also created ripples among European policymakers and the European Central Bank (ECB), which is actively advancing its digital euro project. Despite being the first major economic bloc to establish a comprehensive regulatory framework for crypto-assets with its Markets in Crypto Assets (MiCA) regulation, Europe does not currently prioritize stablecoins. Experts warn that Europe risks repeating past regulatory missteps by over-regulating a nascent market, potentially allowing American platforms to dominate it. Gilles Chemla, a finance professor at Imperial Business School and co-director of the university’s Centre for Financial Technology, argues, "MiCA has a number of restrictions and many in Europe appear to be focused on protecting banks rather than embracing technological innovation. Stablecoins enable easy access to US short-term government bonds from all parts of the world, which also diverts capital flows from the EU and the UK to the US." Concerns about financial sovereignty are a primary driver behind the EU’s digital euro program, as it seeks to reduce its reliance on dominant US payment networks like Visa and Mastercard.

However, some experts question the feasibility of this objective if dollar-denominated stablecoins become widely adopted across Europe, and whether a digital euro is the most effective instrument to achieve this goal. Peter Bofinger, an economist at Würzburg University and former member of the influential German Council of Economic Experts, states, "The digital euro in its current design is narrowly focused on the euro area as a means of payment only for private households and with holdings limited to €3,000, while stablecoins offer an international payment scheme that can be used by global companies." He suggests that integrating existing national payment systems might offer a more advantageous path for the EU.

Should dollar-backed stablecoins gain widespread public adoption in the Eurozone, the ECB would face difficult choices. Lucrezia Reichlin from the London Business School, a former ECB Director General of Research, warns, "There is a risk of dollarization. Dollar-backed stablecoins could become what the eurodollar market is now: a big offshore dollar-based market. If Europe doesn’t develop euro-pegged stablecoins, the old payment system could be dollarized, especially large cross-border payments. Europe is complacent about this risk." Conversely, some analysts dismiss these dollarization concerns as exaggerated. Bofinger suggests, "The ECB is raising the risk of dollarization to justify the need for a digital euro. There’s no such risk, because currencies are like languages: to switch from a domestic currency to a foreign one, the domestic currency has to be in a terrible state, like in some Latin American countries."

Another significant concern for the ECB is that dollar-backed stablecoins could erode the euro’s international standing. Their widespread adoption in Europe might also weaken the ECB’s control over monetary policy. "Every tokenized dollar transaction strengthens the dollar’s global position, even beyond US borders. A euro CBDC cannot match that momentum, and will likely be slower, more limited, and less compatible with global blockchain systems," states Mareneck of Cosmos Labs. Reichlin further elaborates, "It was a mistake of the ECB to think of CBDCs as an alternative to private stablecoins. These are two different things. CBDC is similar and complementary to cash, whereas stablecoin is complementary to deposits. There is no reason why CBDCs and stablecoins could not coexist."

Bubbly Prospects and Systemic Risks

Nearly two decades after the 2008 credit crunch, policymakers remain acutely aware of its lingering effects. Stablecoins are expected to be backed by safe, liquid assets, and users should be able to redeem them at par. Paul Brody, a blockchain expert at Ernst & Young, suggests, "Because stablecoins are not lent out the way bank deposits are, you can argue that in some respects they are likely to be at lower risk than bank deposits, though governments are more likely to bail out banks than stablecoin companies." However, economists caution that stablecoin issuers effectively function as shadow banks, but without the same capital requirements, access to central bank liquidity, or regulatory oversight. A collapse in confidence in their reserves could trigger cascading effects into bond markets and precipitate liquidity crises, mirroring the panics of 2008 and 2020, and potentially forcing governments into politically unpopular bailouts. Krishna Subramanyan, CEO of Bruc Bond, a cross-border banking and payments provider, warns, "If a major stablecoin issuer is unable to meet redemptions or discloses reserve weaknesses, trust could unravel quickly, prompting mass withdrawals. The impact would extend beyond digital assets, affecting wider financial markets that rely on tokenized instruments for settlement and liquidity."

A paramount concern is the potential for speculation to once again overshadow regulatory prudence. Although the GENIUS Act prohibits the issuance of interest-bearing stablecoins, it does not explicitly forbid third parties from offering interest-bearing financial products that incorporate stablecoins. Experts warn that the creation of such reward-based products could foster a parallel deposit market that competes on yield with only a tenuous guarantee of one-to-one convertibility, thereby complicating monetary control. The IMF, in a recent financial stability report, cautioned, "Because stablecoins are vulnerable to runs, a fire sale of their reserve assets – such as bank deposits and government debt – could spill over into bank deposit markets, government bond markets, and repo markets." Susana Esteban from FTI Consulting proposes, "A practical safeguard is integration rather than prohibition: preserve monetary control by including stablecoin flows in the liquidity toolkit using facilities such as the Standing Repo Facility and Reverse Repo Facility to absorb shocks while supervisors treat major issuers as systemically important payment institutions subject to stress testing and live disclosure."

Security remains a critical vulnerability. Some experts contend that, like other forms of cryptocurrency, stablecoins could be exploited for illicit activities such as money laundering and are susceptible to cyberattacks and technical failures. To mitigate these risks, stablecoin issuers would likely need to secure insurance to reimburse holders in the event of cyberattacks and operational disruptions, which would inevitably increase their costs. Political uncertainty could also fuel volatility; a future Democratic administration might implement more stringent regulations on stablecoins. Maja Vujinovic, CEO of Digital Assets at FG Nexus, a digital assets holding firm, predicts, "Expect a revisit of the CBDC ban, stricter consumer protections, and tighter perimeter rules for issuers regarding resolution, interoperability and wallet safeguards."

By the time of the next presidential election, the United States’ financial experiment with stablecoins may have grown too substantial to fail. The wager is audacious: that the profit motives of dollar-denominated token issuers will align seamlessly with national interests. In this context, the GENIUS Act presents a paradox: it aims to enhance dollar supremacy while simultaneously diluting Washington’s direct control over money creation. Can this hybrid model of monetary sovereignty – one where Wall Street and Silicon Valley dictate the terms of global finance, rather than the Federal Reserve – fulfill the expectations of crypto enthusiasts, including the current administration, or will it sow the seeds of the next financial crisis? The ultimate answer hinges on the enduring forces that have historically shaped financial markets: confidence, liquidity, and the unwavering belief that the system, despite its imperfections, will ultimately endure.